According to Idriss J. Aberkane (holder of 3 PhDs), the quantum computers currently under study will be so powerful that they will be able to break the security of some Bitcoin wallets.

In February 2025, Microsoft claims to be able to use its potential Majorana quantum chip to create topological qubits which are the basic units of a possible new type of large-scale so-called "topological" quantum computer.

After more than ten years of research and several failures, Microsoft has presented to the world a completely new method for stabilizing quantum information bits, which paves the way for an absolutely major revolution for the entire 21st century.

Because let's be clear, says Idriss J. Aberkane: what Microsoft has presented is at least as important as the appearance of the transistor in the 20th century. Their Majorana Zero Mode or topoconductor makes it possible to stabilize quantum bits without extreme cooling, thus miniaturizing them so that we could soon have a million qubits in any computer. No one measures the extraordinary consequences of having such a computing capacity.

Idriss J. Aberkane explores them in this video in French.

https://youtu.be/_bEl6413bA8

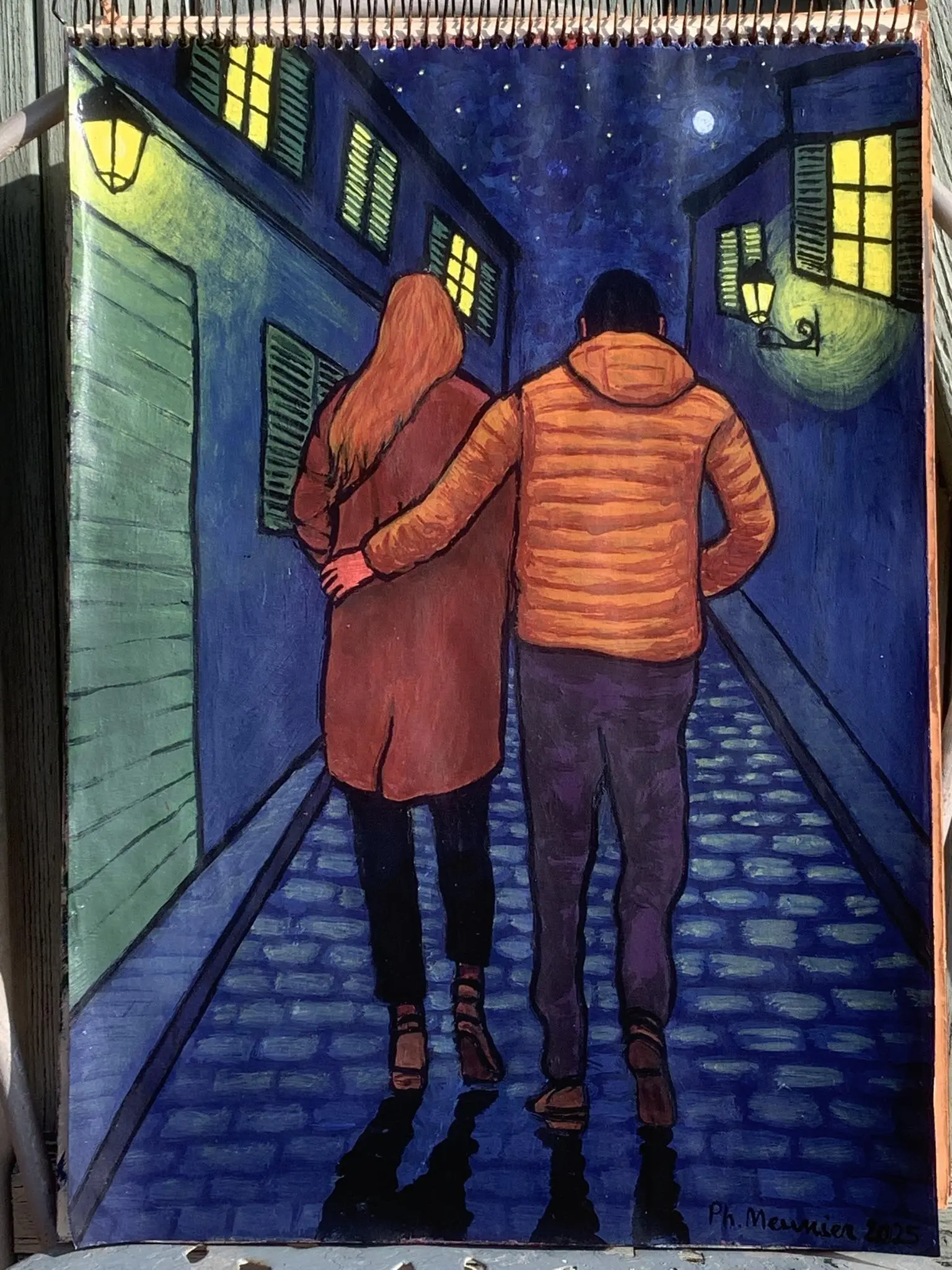

Lovers' stroll in the moonlight

Acrylic on paper 42x29.7cm

2025

From a street scene I photographed last month

Lovers' stroll in the moonlight

Acrylic on paper 42x29.7cm

2025

From a street scene I photographed last month

We've been getting a lot less diamonds since Focus launched. Is that the case for you too?

Back in the day,on diamondapp, I used to receive a lot more diamonds daily than I do now. So, on Focus, what’s the reason you’ve stopped liking to give diamonds? I’ve always advocated for giving diamonds to others’ posts, but on Focus, I’m facing two challenges:

Clicking the 💎 icon brings up a selection for the amount, and since I usually prefer to give $0.1, I have to move the cursor all the way to the left to choose “$0.1,” which adds unnecessary difficulty.

When I see someone has replied to my post in the notifications, I want to reward them with diamonds, but there’s no option for that. I have to go back to my post’s main page to add diamonds, and these cumbersome steps are hindering my actions.

So, here’s what would work better:*A single click on the 💎 icon should directly give a fixed amount of diamonds—no need for two steps.

*Add a 💎 icon to notifications for replies, making it easy to reward them with diamonds.

My last painting

Woman in front of a Picasso painting

Acrylic on paper 42x29,7cm.

2025

From a scene I photographed last month during a visit to the Picasso Museum in Antibes, Côte d'Azur, France.

I asked Grok what are DeSo's chances of success?

Grok's conclusion is: "It’s less about the tech itself and more about whether people will still bet on a project tied to a founder in hot water."

Read Grok's full answer:

"Predicting DeSo's chances of success is tricky, especially with Nader Al-Naji facing fraud charges from the U.S. government in 2024.

In July 2024, the U.S. Securities and Exchange Commission (SEC) and Department of Justice charged Nader with fraud over his earlier project, BitClout. They say he raised over $250 million by selling tokens (BTCLT) without proper registration and misled investors about how the money would be used. Allegedly, he spent millions on personal luxuries—like a mansion and gifts to family—despite promising the funds wouldn’t go to him or his team. These charges aren’t directly about DeSo, but since BitClout morphed into DeSo, the fallout casts a shadow over it.

So, what does this mean for DeSo’s future?

The Challenges

1. Trust is Shattered: People might not trust DeSo if its founder has a cloud of fraud hanging over him. Investors, developers, and users could hesitate to get involved, fearing the project’s leadership isn’t reliable. Trust is everything in a space where you’re asking people to put their money and data on your platform.

2. Legal and Financial Fallout: If Nader loses these cases, he could face jail time (up to 20 years for wire fraud) or hefty fines, draining resources and focus from DeSo. Even if he fights the charges, legal battles are expensive and distracting. Plus, the SEC named DeSo in its complaint, which might signal broader scrutiny of the project.

3. Competition is Fierce: DeSo isn’t the only player trying to decentralize social media. Other blockchains like Ethereum and Solana already host similar apps, and they don’t have the same baggage right now. If DeSo stumbles, users and developers might just jump to those alternatives.

4. Momentum Loss: DeSo raised $200 million from big-name investors like Andreessen Horowitz and Sequoia back in 2021, and it has a community of apps built on it. But the charges could scare off new investment and slow down development. Without fresh energy, it risks fading away.

The Possibilities

On the flip side, DeSo isn’t necessarily doomed:

1. The Tech Could Stand Alone: DeSo is open-source, meaning its code is public, and others can keep building on it even if Nader steps back. If the community believes in the idea—decentralized social media with strong user control—it could survive his personal troubles.

2. Nader’s Response: He’s claimed (via DeSo’s statements) that he’s still committed to the project and sees this as a hurdle to overcome. If he clears his name or hands off leadership cleanly, DeSo might regain traction.

3. Niche Appeal: Some users love the idea of owning their data and resisting Big Tech censorship. If DeSo can deliver on that promise with working apps (like Focus or Diamond), it might carve out a loyal following, charges or not.

What’s Likely?

Honestly, the odds look tough right now. The fraud charges aren’t just a PR hit—they’re a practical blow. Building a successful blockchain needs trust, money, and a clear focus, all of which are wobbly for DeSo at the moment. Nader’s past—returning $133 million from his failed Basis project in 2018—gave him some credibility, but this new scandal could erase that goodwill. Plus, the crypto world moves fast; if DeSo stalls, others will fill the gap.

That said, it’s not impossible for DeSo to pull through. If the community rallies, new leaders step up, and the platform proves it can deliver real value (like a killer app that draws users), it could weather the storm. But as of February 26, 2025, with the legal mess still fresh and unresolved, DeSo’s chances feel more like a long shot than a sure thing. It’s less about the tech itself and more about whether people will still bet on a project tied to a founder in hot water."

Brootle just published a post called NADER CONTROLS EVERYTHING. Since I don't understand any of the blockchain jargon, I asked Grok (X's AI) to explain to me what's going on in simple terms. Here's Grok’s answer:

Alright, let’s break this down into simple terms so you can understand what this DeSo user (who’s also a developer) is saying about the DeSo network and its new app, Focus. I’ll avoid the technical jargon and explain it like we’re chatting over coffee—no blockchain expertise required!

What’s Happening When You Launch a Coin on Focus?

Imagine you’re an artist creating your own special “fan tokens” (like a digital collectible) using the Focus app on the DeSo network. These tokens are called “coins” here, and they’re tied to you—people can buy them to support you or trade them. When you “launch” your coin on Focus:

Your Coins Are Created (“Minted”): The system makes these digital tokens for you. Think of it like printing your own custom trading cards.

A Special Account Is Set Up: This account, called an “AMM account,” is like a middleman or a trading booth. Your coins get sent there automatically.

People Can Buy Your Coins: Fans use $focus (the main currency in the Focus app) to buy your coins from this AMM account. It’s like they’re swapping their money for your trading cards at the booth.

What’s an AMM Account?

“AMM” stands for “Automated Market Maker.” Picture it as a vending machine that handles trading for you. When someone buys your coin with $focus, the vending machine collects their $focus and gives them your coin. Later, it can use that collected $focus to buy more of your coins back, keeping the trading going. This happens automatically after a set time (when the “timer goes to zero”), and the AMM starts placing “orders” (like putting up signs saying, “I’ll buy or sell these coins at this price”).

For example, if your username is

@WhaleDShark

, your AMM account might be something like @AMM_WhaleDShark_76_SWfzF. When people buy your coins, the $focus they spend piles up in that AMM account.

The Big Question: Who Owns This AMM Account?

Here’s where the developer’s post gets spicy. They’re pointing out something surprising: you don’t own that AMM account. Instead, it belongs to Nader (the guy who created DeSo and Focus) and his team at DeSo. So, all the $focus that collects in these AMM accounts—across every coin launched on Focus—is under their control, not yours.

To stick with our analogy: you’re the artist making trading cards, but the vending machine selling them (and holding the money) belongs to Nader. You might’ve thought you’d get to keep the cash piling up in there, but right now, it’s all going to him and his team.

Why Does This Matter?

The developer is raising a red flag: even though DeSo is supposed to be “decentralized” (meaning no single person controls everything), this setup makes it look like Nader has a lot of power. All those $focus tokens piling up in the AMM accounts? They’re in his hands, not the hands of the people who launched the coins (like

@WhaleDShark

or others). The developer even repeats “NADER CONTROLS EVERYTHING” to hammer home the point—it feels centralized, not decentralized.

What About Getting Your Coins Back?

Nader has apparently talked about adding a way for users to “close” the AMM account and take back their coins (and maybe the $focus too), but that option doesn’t exist yet. So, for now, once your coins are in that vending machine, they’re stuck there, and Nader’s team runs the show.

What’s the Developer Upset About?

In simple terms, they’re frustrated because:

They expected more control over their own coins and the money made from trading them.

Instead, Nader and the DeSo team hold the reins, which feels unfair or sneaky to them.

It’s like setting up a lemonade stand, but someone else owns the cash register and keeps the profits.

How Does This Affect You as a Regular User?

If you’re just someone using Focus to buy coins or support creators, this might not directly change your day-to-day experience. But it’s a peek behind the curtain: the system isn’t as “user-owned” as it might seem. The developer is warning that Nader’s team has more control than people might realize, which could affect trust in Focus or DeSo down the line.

In Summary

When you launch a coin on Focus, your coins go into an automatic trading system (the AMM account) that Nader and his team own. The $focus people spend on your coins collects there, and right now, you can’t touch it—Nader controls it. The developer thinks this is a big deal because it suggests Nader has more power over the system than users might expect from a “decentralized” network.

When you launch a coin via @focus your coins get minted, AMM account is created and your coins transferred to that account. When timer goes to zero that AMM account is placing orders into order book.

For example for @WhaleDShark that account is @AMM_WhaleDShark_76_SWfzF and when somebody buys coins from AMM with $focus, those $focus get into AMM account and AMM account is placing buy order backed by those $focus coins.

So $focus tokens eventually get accumulated in AMM accounts... Now wait for it... Here is the fun part... Who do you think owns AMM account associated with your coin?

AMM accounts created during coin launch via @focus belong to @nader At the end of the day AMM service is run by @deso team and they own all those AMM accounts. @nader was saying something about giving ability for users to close AMM and get all coins back, but there is no such option yet.

NADER CONTROLS EVERYTHING

PS buy more $brootle to read cool content like that, no AMM, no fees openfund.com/trade/brootle

Meanwhile, in Elon's country...

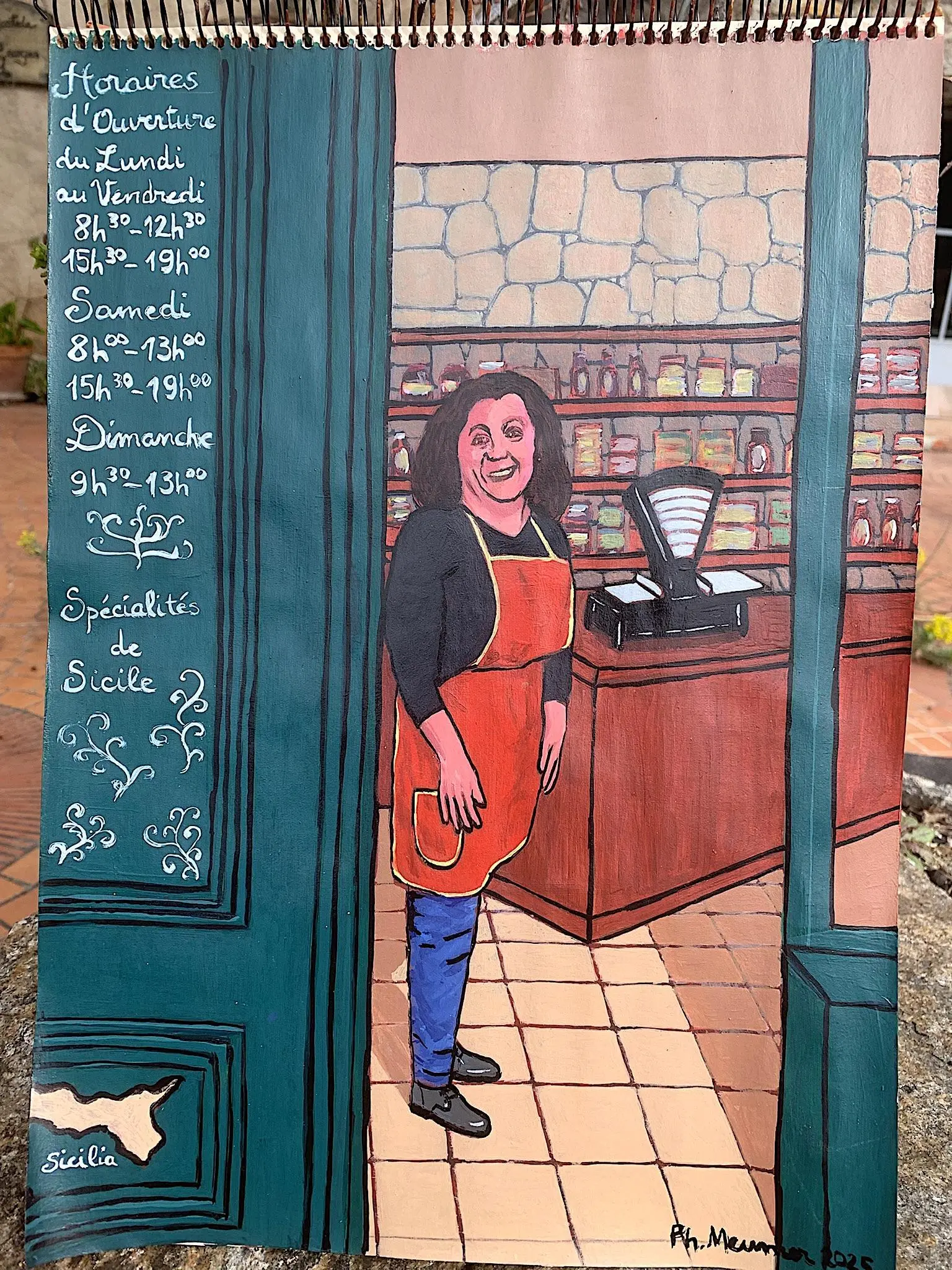

La Bella Sicilia - Sicilian Grocery

Acrylic on paper 42x29.7cm.

Draguignan, France, 2025.

Not far from home, where we go to buy our amaretti (small Italian almond-based cakes). Mmmh 😛

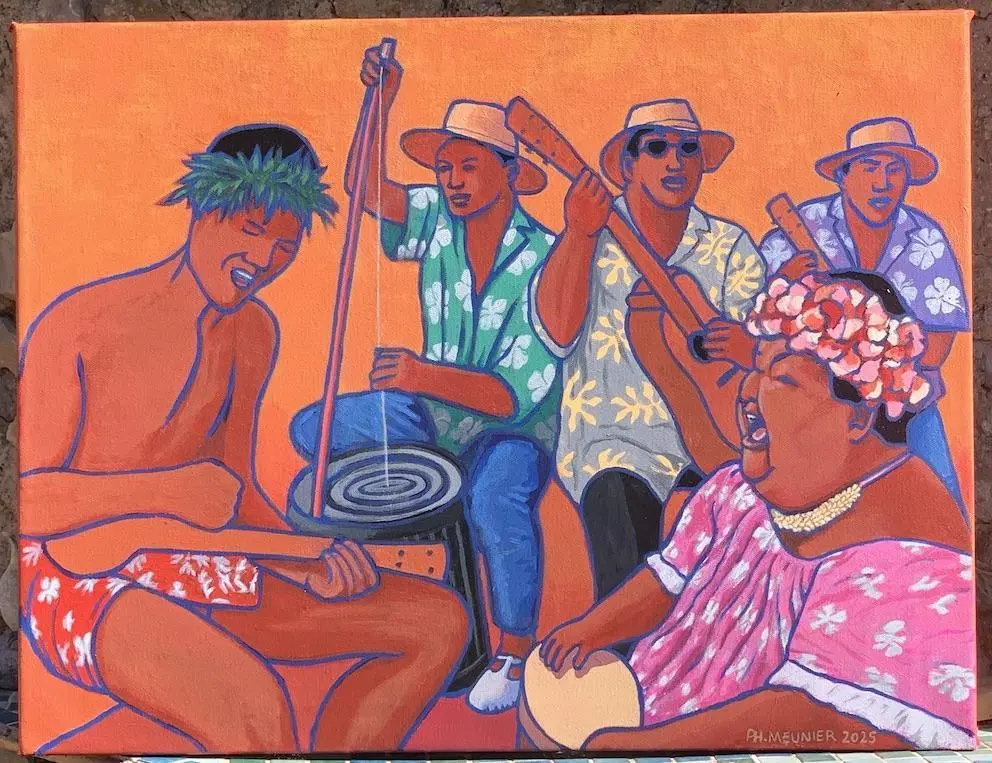

My painting "Tahitian Party" won the 1st jury prize and the 3rd public prize at the Gauguin Awards in February 2025. This is a year that's off to a good start!

Should I mint an NFT?