Trustees, Crypto, and Tokenization: A Shift Toward a New Economic Model?

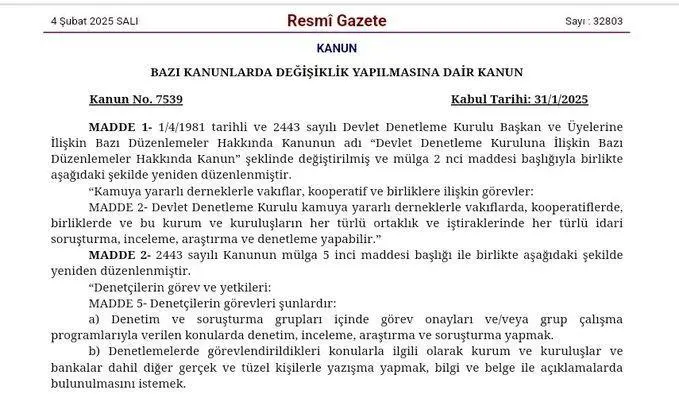

It seems that Turkey continues to surprise. The legal amendment published in the Official Gazette on February 4, 2025, which expands state oversight over public benefit associations, foundations, cooperatives, and many other entities, has sparked debate at the intersection of traditional finance and next-generation financial models. From a tokenization perspective, the key question is whether this represents a step towards financial digitalization or a further deepening of centralized control.

resmigazete.gov.tr/eskiler/2025/02/20250204-1.htm

Diverse Interpretations of the Law

The new regulation grants the State Supervisory Board (DDK) broader authority to scrutinize organizations with public benefit status, closely monitoring fund flows and financial movements. Government officials insist that this is an effort to increase financial transparency. However, the Turkish Industry and Business Association (TÜSİAD) sees this as an encroachment on the private sector’s financial autonomy. A TÜSİAD representative remarked, "This law not only increases supervision but also reinforces financial centralization. However, economic growth thrives when decentralization fosters room for innovative initiatives."

The Ministry of Economy, on the other hand, presents a more constructive view: "Enhancing oversight is crucial for economic stability. Before integrating emerging financial models such as crypto and tokenization, existing systems must first be transparent and reliable."

Tokenization and Emerging Financial Structures

Globally, state-backed applications of blockchain and tokenization are increasing. In Latin America and Asia, tokenized assets are gaining traction as a means to enhance financial transparency and attract alternative capital inflows. If Turkey aims to become a leader in this field, it must successfully integrate Web3 frameworks with traditional financial models.

Economic analysts argue that the new law signals a shift toward a hybrid economic system—one in which centralized regulation intensifies on one hand, while the infrastructure for decentralized finance (DeFi) and tokenized securities is simultaneously developed on the other. Experts suggest, "While the state appears to be increasing its central control, if a hybrid model supporting digital transformation and tokenization emerges, Turkey could become a financial innovation hub."

Trustees and Tokenization: A Paradox of Financial Future?

Concerns have been raised that increased state oversight of public-benefit organizations may lead to more frequent trustee appointments. The law grants the State Supervisory Board investigative authority, opening new possibilities in the legal framework. This raises the question: "Are trustee appointments a tool for financial stabilization, or merely a mechanism for strengthening centralized control?"

This presents a paradox: tokenization is fundamentally built upon decentralized financial ecosystems. On the one hand, the government is seeking to integrate Web3 and blockchain technologies, while on the other, a law reinforcing traditional financial oversight mechanisms is being enacted.

State-Supported DAOs: A Model for Strengthening Local Economies

One solution to the emerging paradox could be the implementation of state-backed DAOs (Decentralized Autonomous Organizations) to foster public-benefit financial initiatives. Several jurisdictions, such as Wyoming and Switzerland, have already begun experimenting with legal DAO frameworks. If Turkey were to integrate government-regulated DAOs, it could:

Enhance fund transparency while preserving decentralization.

Support local economic initiatives through tokenized fundraising mechanisms.

Establish Web3-based regulatory sandboxes to test new financial models before large-scale implementation.

This approach would enable the state to maintain oversight while allowing Web3-native financial institutions to operate within regulated tokenized frameworks. In the long run, a hybrid model combining compliance and decentralization could position Turkey as a regional leader in tokenized finance.

A Hybrid Financial Future

Turkey stands at the threshold of a new economic paradigm. However, for a successful transition, this hybrid system must be implemented transparently, ensuring a balance between financial centralization and Web3 innovation. If executed correctly, tokenization, DAOs, and hybrid regulatory models could redefine Turkey’s financial ecosystem, paving the way for an efficient, transparent, and decentralized future.

Kayyumlar ve Tokenizasyon: Finansal Geleceğe Sarılan Bir Paradoks mu?

4 Şubat 2025 tarihli Resmî Gazete'de yayımlanan ve kamu yararı dernekleri, vakıflar, kooperatifler ve birçok diğer yapıya devlet denetiminin arttırılmasını öngören yasa değişikliği, klasik ekonomi ile yeni nesil finans modellerinin kesişme noktasında farklı tartışmalara neden oldu. Bu değişiklikler tokenizasyon perspektifinden ele alındığında, sistemin dijitalleşme adımı mı yoksa finansal merkeziyetin daha da derinleşmesi mi olduğu sorusu öne çıkıyor.

View this post at diamondapp.com/u/metaturk/blog/kayyumlar-ve-tokenizasyon-finansal-gelecege-sarlan-bir-paradoks-mu