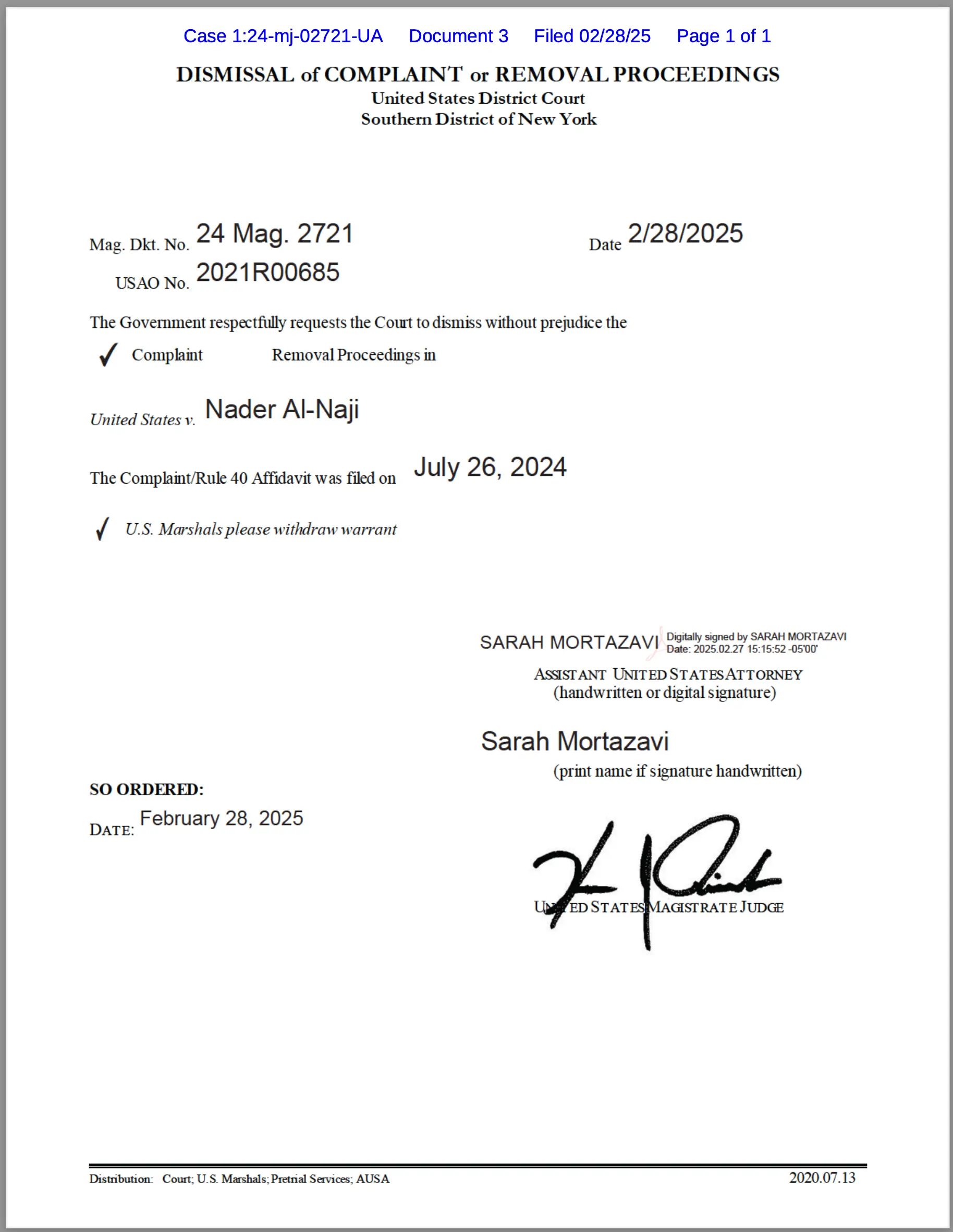

The rumors are true and I can finally talk about it: The DOJ has dismissed its case against me and my name has been cleared.

This is an amazing result for me, for my family, for my team, and for DeSo. There is no limit to what we can achieve from here.

At some point, I'll share my full story. But for now, I just want to clarify a few important points since I can now speak openly.

1. My innocence withstood intense scrutiny. The government meticulously combed through my private texts, my private emails, and even private documents I'd written looking for any shred of wrongdoing. They went to people I'd done business with and essentially pressured them to say bad things about me (which nobody did, not even people I'd let go in the past). The process was extremely adversarial. They weren't looking for a reason to clear me, they were looking for a reason to convict me, and any reason would have worked as long as they thought it would convince a jury.

After months of searching, using every method and tool at their disposal, including applying pressure to those around me, the government decided to dismiss their charges.

It's hard to understate how rare a dismissal like this is. After going through this process myself and seeing what the government is capable of, I believe it's highly unlikely that anyone who has ever done anything wrong, or even anything that "feels" wrong, would ever survive the government's scrutiny without being convicted.

I truly believe it only happened in my case because I've always gone above and beyond to do right by everyone I've ever done business with, and because I truly believe in my heart that what we're doing with DeSo is important for the world (and this came out in all my private communications).

2. There was no victim. In their complaint, the government claimed that a conversation they had with "Investor-1" led them to believe that I had defrauded this investor. Many things were incorrect about this claim after it was scrutinized:

1) I never lied about anything. In fact, I was beyond transparent at all times, and I'm confident that Investor-1 would agree

2) Investor-1 was and still is up on their purchase, even after the government's FUD tanked the price by over 70%

3) I am confident that Investor-1 does not consider themselves to be a victim.

Not only that, but Investor-1 has never been anything less than an amazing partner to me all throughout my career for almost a decade now. When I saw them mentioned in the complaint I immediately suspected that the government had compelled their testimony, and was either misunderstanding or misrepresenting an innocent conversation to reach the conclusion they wanted to reach.

I believe that if you asked Investor-1, the only entity they'd consider themselves a victim of is the US government for wasting so much of their time, and for costing them more in legal fees than the amount allegedly lost to fraud (which to be clear was zero because they are still up on their original purchase of tokens).

In summary: I believe the case that was brought against me consisted of a no-loss non-fraud against an alleged victim who doesn't even consider anything negative to have occurred, other than the actions of the government itself.

3) DeSo is fully-decentralized. Perhaps the allegation that hurt the most was the government's claim that BitClout/DeSo, the blockchain that I've been working on for years now, is not fully-decentralized. They did this by pulling a text message I sent out of context. In the message, I said something like "even something that is fake decentralized would probably still not be a security." Right *after* that message I clarified that BitClout/DeSo is *actually* decentralized, and thus has virtually no securities risk as a result. Unfortunately, the government didn't include that context in their complaint, which in my opinion is an act of bad faith on the government's part.

For the avoidance of doubt, I will say on the record right here and now that BitClout/DeSo has been fully-decentralized from approximately late 2020. To say I thought anything else would not only be wrong, it would contradict actual hard fact.

4) This was some hard stuff. A lot of things about what I went through were hard. One day I will tell the whole story and I think it will be quite interesting for people to hear-- but not today.

I don't want to come off as arrogant or hyperbolic, but I feel I have to give my honest assessment and say that I'm pretty sure something like this would have broken most people. There is something "life or death" about a crisis like this that I feel few working in traditional companies have ever really dealt with, even at the highest levels. At minimum, it would break their team and make it hard to continue to operate normally...

This being said, I'm proud to say that our team remained solidly intact, and we even successfully launched two major products through all the noise: Openfund and Focus (which you should try, by the way), as well as a major network upgrade to Proof of Stake.

I always knew that I hadn't done anything wrong and that it would all get resolved. But everyone around me did as well, including my team. That belief, combined with the absolutely heroic support of my friends and family, made it manageable without too much stress. And of course, it doesn't hurt that I believe DeSo is one of the most important things I can be doing for the world, and worth fighting to the death for.

Lastly, I have to mention that if it weren't for all of the efforts of others in our industry, especially @brian_armstrong and his work with Coinbase, I'm not sure crypto would be where it is today, and I'm not sure we would have gotten such a swift dismissal of my case.

===

In the short-term, I've got big plans for DeSo, Focus, Openfund, and HeroSwap (my team's core products). Every single one is best-in-class at what it does and a potential billion-dollar business on its own. Now that I'm able to operate at full capacity, free from stifling constraints, and with my reputation and network restored, I'm confident we'll realize that potential.

Now, let's get back to work.

people are getting upset again at elon and X and its censorship

also, as x has now been resold to xai, its back in control of the claws of global asset managing firms like blackrock

i am full of love and microplastics

Rich isn’t the same as prerich.

Rumor has it that Nader is taking DeSo private at $420.69.

Weekend Review - March 30th, 2025.

🎢 Overarching Themes

- Trend: Indices in Downtrend

- AI Bubble: Still early innings, lead by themes in - AI, robotics, crypto, cybersecurity, and software.

- 3 Trillion Club & Market Cap Expansion: MSFT, NVDA, and AAPL.

- Outlook: Expecting a choppy and volatile 2025 as these trends evolve. Possibly a smoother second half of the year as uncertainty diminishes.

📊 Weekly Themes:

Pivots failed to end the week with NASI hinting at hooking lower after a very short rally. Risk off ultimately, if we get some stability in the market, and NASI holding, then we want to see the pivots below from last week hold, they remain the same.

- QQQ needs to hold $472.73

- NVDA $118.42

Key Pivots:

12 month ema:

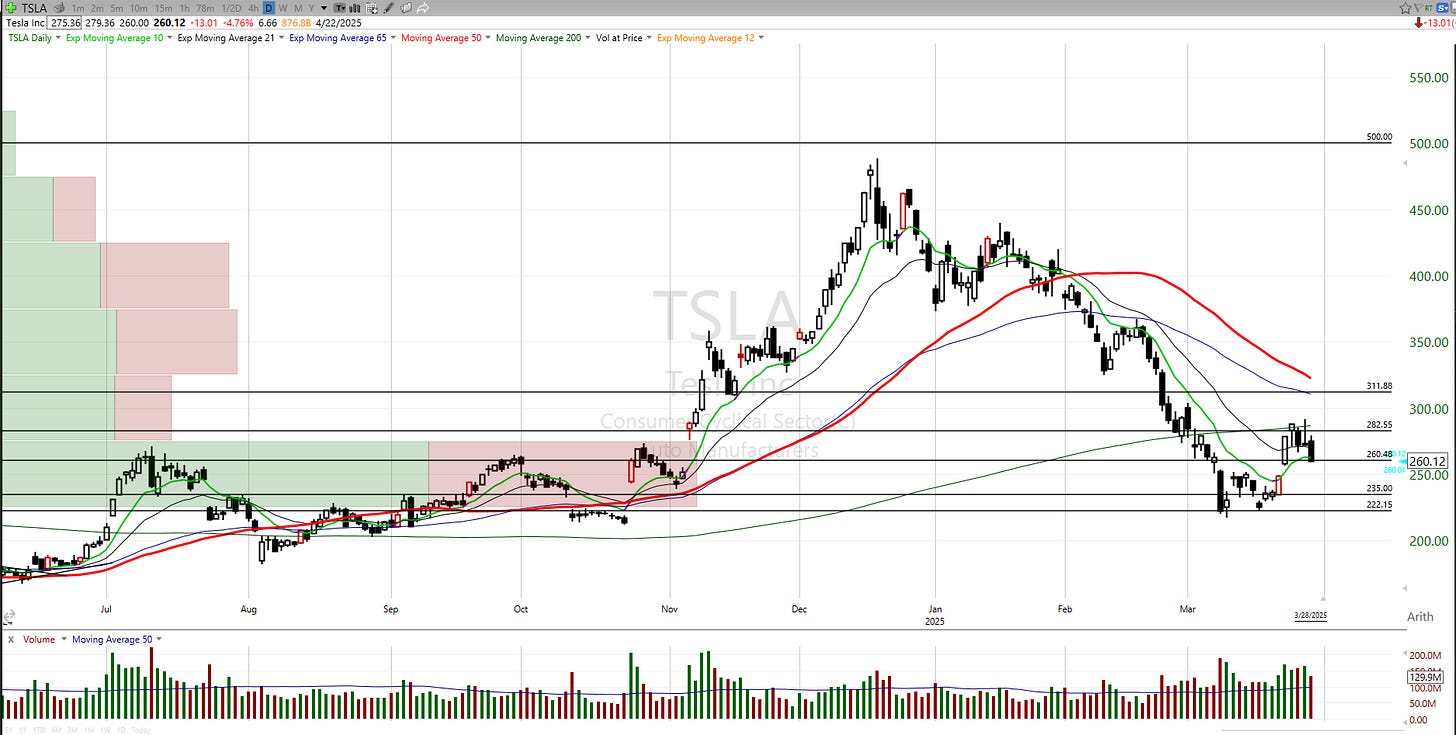

- TSLA: $282.43

- AMZN: $195.70

- GOOGL: $169.39

- MSFT 404.02

3 trillion market cap recoveries?

NVDA and MSFT have dipped below, they’d recover these levels at:

- NVDA: $122

- MSFT: $403.77

📆 Events

Economic Calendar:

- Monday: Chicago PMI

- Tuesday: Manufacturing Data + JOLTS (Feb)

- Wednesday: ADP Non farm employment change (Mar), Factor orders, Crude Inventories

- Thursday: OPEC Meeting, Jobless Claims, Trade balance, Fed’s Balance Sheet.

- Friday: Jobs Data, Fed Speakers

Thoughts:

McClellan Oscillator Analysis:

- Current Reading: -53.01

- NASI: 37.91

- Interpretation: Despite the NASI hooking higher 3/14ish, it’s now looks like it wants to hook back down. Half backed rallies of the NASI can be dangerous, and this was confirmed by indices rallying into the 200sma and revisiting lows fairly broadly.

The market’s inability to rally is evident. The pivots we’ve highlighted over the last few weeks have failed. The NASI hooked higher but is now hinting at a hook lower. Odds are still split on whether it has more room or not, but current action suggests a sloppy, grinding environment rather than an easy dollar scenario.

I haven’t discarded the NASI hook just yet, but the price action can’t be ignored. Despite some initial holds, we rallied into hurdles and failed aggressively. My overarching thesis remains focused on an AI bubble, but the market and liquidity suggest it isn’t ready. Our primary indicator for the AI bubble is NVDA, and it’s simply not materializing—price isn’t lying to us, and its inability to hold pivots and clear hurdles is noted.

The last bubble comparable to the one we’re discussing now is the dot-com bubble, where we rallied into $2000 and failed hard in 1998, and then rallied in historic fashion. Will history repeat itself in identical fashion? Who knows. However, given my strong conviction that an AI bubble is brewing, I believe this scenario is the most likely—at least to me.

On a weekly chart, the $2,000 top then corresponds to the $20,000 top of today in the Nasdaq.

**Indices:

**To keep things as simple as possible, I’m going to keep the analysis super tight and easy to follow.

Last week, we focused on two key levels for QQQ: the 12-month level around $480 and the $473-ish HVC. Both failed—price action doesn’t lie, and it’s clear the market simply isn’t ready. Until we reclaim these levels, it’s a risk-off environment. Even short-term rallies to these levels need to be confirmed by a sustained NASI hook that holds for more than a day, supported by broader market strength.

Institutional Stocks:

One of our overarching views was a market cap expansion to $3 trillion and beyond, focusing on MSFT, NVDA, and AAPL. The idea was that if an AI bubble were brewing, these names could reach $5-10 trillion in a bubble scenario. However, as of Friday, the market has proven this hypothesis wrong—at least in the short term. Over the past few weeks, both MSFT and NVDA have broken below $3 trillion and failed to reclaim those levels.

We also highlighted GOOGL and AMZN at $2 trillion, but GOOGL has fallen below this mark, while AMZN is hanging on by a thread. AAPL remains above $3 trillion, but it faces challenges if it drops below the $209 HVC. Additionally, we emphasized the importance of these stocks reclaiming their 12-month EMA, which has been our trend guide for over seven years. Unfortunately, none were able to recover it. Here are the key levels from last week:

- TSLA: $282.43

- AMZN: $195.70

- GOOGL: $169.39

- MSFT: $404.02

For institutional names, we need to see these market caps and 12-month EMAs regained before we can become more optimistic, or at the very least, observe some form of bottoming pattern. For now, these are the critical levels unless a steep correction occurs.

TSLA a one week rally after 9 weeks down.

AMZN closing right at 2 trillion, failed the 12 month recovery, and right back a recent lows.

MSFT fresh lows and a few weeks under 3 trillion now and a rejection of the 12 month.

Again, need to recover these levels in the short term to get long.

Growth Stocks:

Given everything mentioned above, it’s best to avoid discussing growth names in detail for now. However, if some of the key levels highlighted earlier hold early this week—say Monday or Tuesday—refer back to last weekend’s review for the pivots.

A straightforward example is AMD:

- We identified $112 as a critical level, and it failed dramatically last week.

- $100 remains in play as a potential support level.

Summary:

The outlook for growth stocks remains cautious until key levels in institutional stocks are reclaimed. If we see early strength this week, a closer look at growth names may be warranted, but patience is advised.