I gave you free money, you chose not to take it.

How pre-sale auction works on Focus? (Free)

A Complete Guide on how to participate in token sale auctions.

By @TheRenaissanceMan

Saw many presale orders bidding way too much than needed, that if they had known how it works can make better trades. So I created this guide on how presale bidding works and how to participate in it.

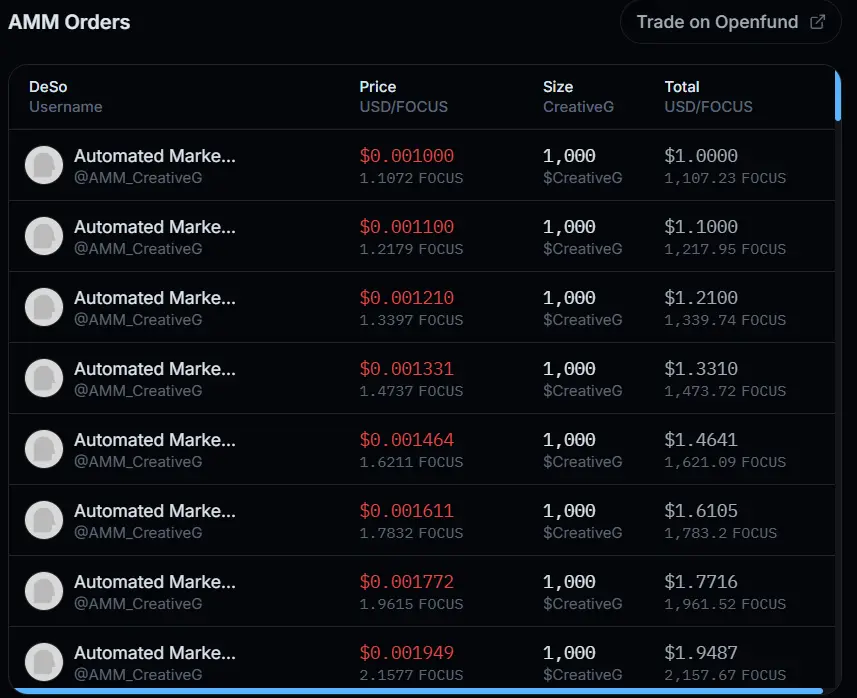

The AMM when first created makes multiple sell orders where the price increase constantly (known as order-spacing) and at each price level there is x amount of coins. See Image below taken from @CreativeG AMM. you can find this at user profile > token tab > AMM tab.

Now based on this AMM let’s see the different Scenarios to understand further.

First Scenario: There are no other bidders than you

If there are no bidders other than you (which is not a good sign but just for example), then you bid at what exactly the AMM is asking for to get the cheapest price.

So you will have an order that looks like this for the example on the Image.

- 0.0010$ for 1000 coins

- 0.0011$ for 1000 coins

- 0.0012$ for **1000 coins **and so on until you reach the amount you want.

Second Scenario: There are other bidders.

In this case you don't buy at the price the AMM is asking for as there are other bidders who are willing to buy at a higher price than the AMM asked. At launch the AMM will start filling the bids from the highest to Bottom. which means, the initial AMM price (The lowest sell price) is matched with the highest bid price.

let’s assume the highest bid is 0.01$ for 2000 coins.

The AMM will match this with the initial AMM sell price (1000 coins for 0.001$, see image above). As 0.01$ (Bid price) > 0.001$ (AMM initial price), the order will be filled. But it is filled with 0.01$ (The bid price), more than what the AMM asked for. (The extra money the AMM earned by selling for higher price that is explained by @nader here).

Now the first 1,000 from the 2000 of the highest bid is filled.

The AMM then goes to second sell price level in the AMM (**0.001098$, **see image above). As 0.01$ (highest bid) is > 0.001 (Second level AMM sell price) the order will be filled again (at 0.01$ price).

Now the AMM is done with the highest bid. it will move to the second highest bid. By the time it goes to the second highest bid, the lowest two sell orders (By the AMM) are already gone. So, the AMM price when it reaches the second highest order is 0.00121$ (Third level sell price in AMM, see image). If the 2nd bid price is > than the increased AMM sell price, it will be filled. The AMM will continue to fill the prices down to the bottom in this manner.

So, when it is your turn in the bidders list, if your bidding price is < the increased AMM price, your order will not be filled (and so the rest of the orders below you, as they are even lower)

In this scenario you will need to check the highest bid and the AMM price right after the highest bid is filled. And there are two cases.

Case 1 The current Highest bid price is > The AMM price once the highest bid is filled.

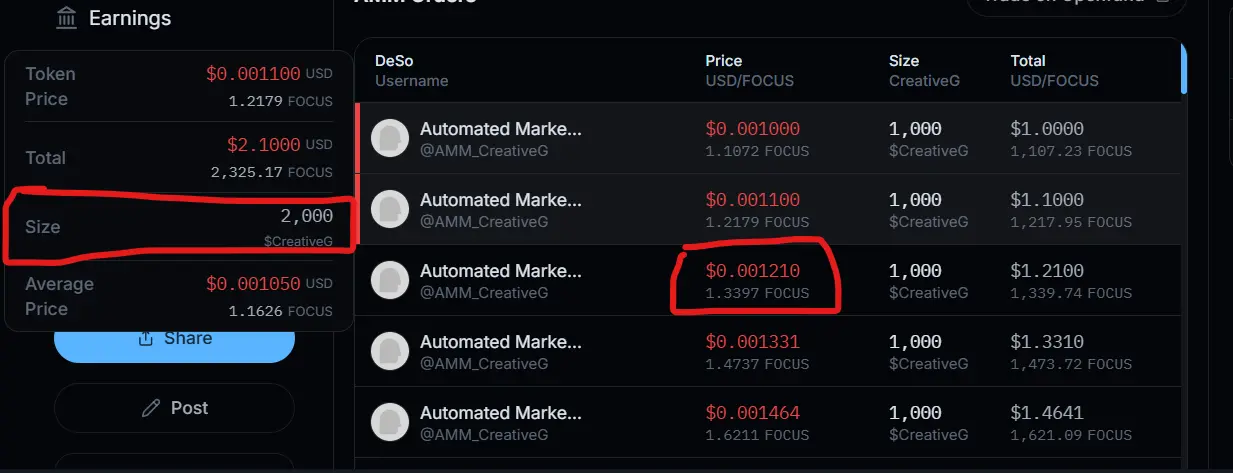

Let’s assume 2000 coins for 0.01$ is the highest bid

you first check the price of the AMM after the first 2000 coins are filled (After the highest bid is filled) by hovering over the AMM sell orders starting from top and watching out for the Size you want.

In the above example, the price after the 2000 size is 0.00121. We assumed the highest bid to be 0.01$ for the first 2,000 Coins. But the next AMM prices after the 2000 coins are filled will be 0.00121$ which is much less than the highest bid price. So, you don’t need to fight for the highest bid, you will just bid to buy the next cheapest prices of the AMM.

Assuming you want to buy 2000 coins, You will submit an order

0.001210 $ for 1000 Coins

0.001331 $ for 1000 Coins

but as submitting for each price level might be a tiresome, you can also merge them at little cost.

0.001331 $ for 2000 Coins

Case 2 The AMM sell price once highest bid is filled > The current Highest bid price

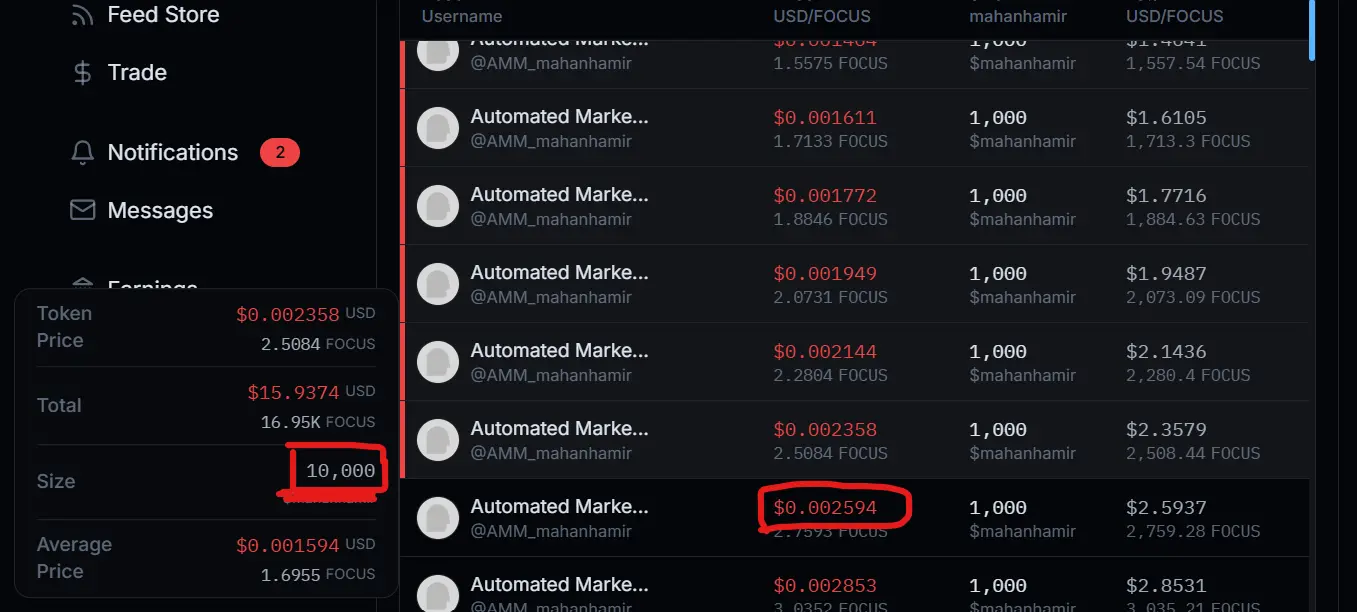

Let’s assume the highest bid is 10,000 coins for 0.001$ each. and the following AMM.

You hover over the AMM list until you see a size of ~10,000 as shown below.

By the time the AMM is done filling the 10,000 coins for the highest bid, the AMM price is going to be 0.00259 Which is greater than the highest bid (0.001$). So you should bid the highest price to get cheapest price.

Tips

- In a real bidding, the bids change a lot at the last second. So be there at the last second to adjust your bidding accordingly and once you identify a good entrance point, you usually need to submit a higher price considering the market changes at last second.

- invest only what you can afford to lose as this is a high-risk market.

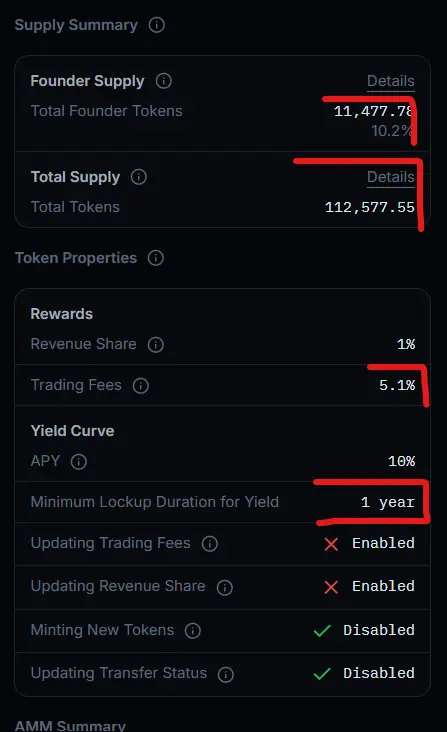

- Always check the all the token properties. Especially Trading fees, Founder supply and Founder lockup and other setting. You can find these at the right or the token graph on open fund (See image below)

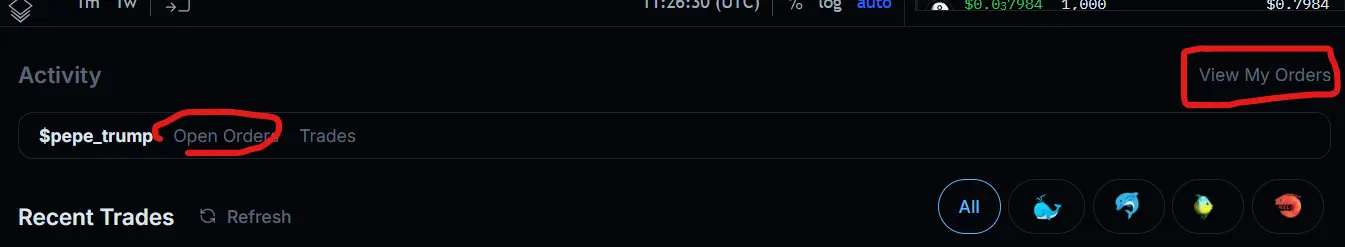

- Always make sure to close your bids once the bidding is over. Every order you make on the bidding is a limit order and it stays open even after the bidding is over. You can find them in the Open orders tab under the graph in Open fund. Or click view orders button at the same place to see open orders on all coins.

- Always be there when the market opens to make sure your bids have passed or otherwise to buy quickly at market price before price soars.

AMM Coin Launches for Dummies 🚀

What is an AMM?

An Automated Market Maker (AMM) is a system that sets token prices and fills buy orders automatically. Instead of using traditional buyers and sellers like a stock market, an AMM uses a pricing formula and a pool of available tokens to handle trades.

When a new coin launches on focus, the AMM starts with a set amount of tokens at different price levels. Buyers place bids, and the AMM fills the highest bids first, giving buyers tokens from the cheapest available price levels.

How AMM Pricing Works on FOCUS

When a new coin launches, the AMM is configured with four key settings:

- Start Price: The lowest price at which tokens will be sold. (Example: $0.001)

- Price Increase %: How much the price increases per level. (Example: 10%)

- Final Price: The highest price at which tokens will be sold. (Example: $10.00)

- Total Tokens in AMM: The total supply of tokens available in the AMM. (Example: 97,000 tokens)

Example Scenario

AMM Price Levels Before Any Orders

We're Launching Dummies coin The AMM Settings are as follows:

Start Price: $0.60

Price Increase: 10% (to simplify well say this is just a flat 10c Increase)

Final Price: $1.00

Total Tokens in AMM: 5000

The AMM will create levels from the start price to the end price each one going up by the amount set in price increase. In this example there are 5 levels, so we distribute the total tokens in the AMM evenly between the 5 levels which gives us:

💰 $1.00 → 1,000 tokens

💰 $0.90 → 1,000 tokens

💰 $0.80 → 1,000 tokens

💰 $0.70 → 1,000 tokens

💰 $0.60 → 1,000 tokens

Total: 5,000 tokens in the AMM

How Bids Are Filled

Buyers place bids, and the AMM fills the highest bids first, pulling from the lowest available price upwards.

Let’s look at the order book for 4 buyers placing bids for this new token launch.

| Username | Tokens bid on | price per token |

|---|---|---|

| Bob | 500 | $1.00 |

| Alice | 1200 | $0.90 |

| Charlie | 1500 | $0.85 |

| Susan | 2000 | $0.75 |

Now let's see how the tokens in the AMM are distributed at launch

Bob's Order (500 tokens at $1.00)

✅ Bob places an order for 500 tokens at $1.00.

✅ The AMM fills his order at the cheapest available level ($0.60).

✅ Bob pays $1.00 per token, but the AMM only “sells” the tokens from the $0.60 price level.

📌 Bob pays: $500

📌 The AMM keeps: $200 profit (the use for this is still undecided by Nader)

📌 Remaining at $0.60: 500 tokens left

Alice’s Order (1,200 tokens at $0.90)

✅ Alice places an order for 1,200 tokens at $0.90.

✅ The AMM fills her order starting at $0.60 (500 tokens).

✅ Then, the AMM fills the rest (700 tokens) at $0.70.

📌 Alice pays: $1,080

📌 The AMM keeps: $360 profit

📌 Remaining at $0.70: 300 tokens left

Charlie’s Order (1,500 tokens at $0.85)

✅ Charlie places an order for 1,500 tokens at $0.85.

✅ The AMM fills his order starting at $0.70 (300 tokens).

✅ Then, the AMM fills 1,000 tokens at $0.80.

✅ Charlie still needs 200 more tokens, but there are no tokens left below $0.85.

📌 Charlie’s order is only partially filled with 1,300 tokens.

📌 Remaining at $0.80: 0 tokens left

Susan’s Order (2,000 tokens at $0.75)

❌ Susan places an order for 2,000 tokens at $0.75, but there are NO tokens left at $0.75 or lower.

❌ Her order is completely unfilled.

Key Takeaways

- The Highest Bids are filled from the cheapest price levels first.

- You must bid high enough to guarantee tokens but you’ll still get the lowest possible price.

- The AMM keeps the difference when buyers overpay (e.g., Bob paid $1.00 but got tokens at $0.60).

- If your bid is too low and tokens run out before reaching your price, your order won’t be filled.

Hi, thanks for the detailed explanation. I though I did understand the token sales auction but I miss totally a step. I hope that you can tell me what I do wrong so that I can learn this for the next time

Example of a launch:

The amm was

0.001 - 1k

0.0011 - 1k

0.00121 - 1k

0.001331 - 1k

0.001464 - 1k

0.001611 - 1 k

0.001772 - 1k

0.001949 - 1k

0.002144 - 1k

initial bids were

person a , 0.001 for 3K coins

person b, 0.011 for 1K

person c, 0.001256 for 6K

person d, 0.001946 for 3K

According to your description, my thoughts

I will bid with 0.002144 for 8k

There were no other bids so, With my highest bit , 0.002144, I can fill every previous level / sell from the AMM

But this was not happening

Results:

I got only 2k for a price of 0.002144.

What am I doing wrong because I do not get the picture at all. If you look at the recent sell trades of the AMM for user btcabi, most of them are for the price 0.0022

I do not get it at all

Thank you so much already !!

Thank you for such a clear explanation. This is such valuable and important information for new users and users who haven't been exposed to this type of system.

Thanks @imoliver, very helpfull. Does it work like that on openfund as well when you place a marketorder for focus or deso?

Good explanation

Thanks @imoliver , great explanation.

Please tell me if I am wrong. Unless your bid is right on spot and the pool is large enough, you always pay more than the real price of the coin at that moment or you can't buy all the coins you ordered. AMM always wins!

Hi, thanks for the detailed explanation. I though I did understand the token sales auction but I miss totally a step. I hope that you can tell me what I do wrong so that I can learn this for the next time

Example of a launch:

The amm was

0.001 - 1k

0.0011 - 1k

0.00121 - 1k

0.001331 - 1k

0.001464 - 1k

0.001611 - 1 k

0.001772 - 1k

0.001949 - 1k

0.002144 - 1k

initial bids were

person a , 0.001 for 3K coins

person b, 0.011 for 1K

person c, 0.001256 for 6K

person d, 0.001946 for 3K

According to your description, my thoughts

I will bid with 0.002144 for 8k

There were no other bids so, With my highest bit , 0.002144, I can fill every previous level / sell from the AMM

But this was not happening

Results:

I got only 2k for a price of 0.002144.

What am I doing wrong because I do not get the picture at all. If you look at the recent sell trades of the AMM for user btcabi, most of them are for the price 0.0022

I do not get it at all

Thank you so much already !!

Thank you for such a clear explanation. This is such valuable and important information for new users and users who haven't been exposed to this type of system.

Thanks @imoliver, very helpfull. Does it work like that on openfund as well when you place a marketorder for focus or deso?

Good explanation

Thanks @imoliver , great explanation.

Please tell me if I am wrong. Unless your bid is right on spot and the pool is large enough, you always pay more than the real price of the coin at that moment or you can't buy all the coins you ordered. AMM always wins!