My preferred play right now is to buy coins that generally average between 7-9 figure volume and has greater than 10% APY from some kind of PoS or inflationary mechanism.

You can find them on stakingrewards.com

Livepeer is one such example where it usually averages 25-50m volume with 50-60% APY from staking depending on the fees it collects from each orchestrator. Injective is another one which is about 12% with 150m average volume.

If you get a portfolio of these at bottom prices, then the yield when they rise will be enough to sell and DCA into your reserves (for me, that’s BTC & DESO) on a steady stream.

Not financial advice. DYOR.

Haven’t been this excited in 3-4 years.

Why would you buy stocks when you can own Bitcoin?

Hmm I wonder what they will discuss.

https://x.com/cointelegraph/status/1909231845717258442?s=46&t=8givghMXErbfpeZpZDJ-hQ

With all of this market turmoil, I hope that AB is doing okay and has put all of our money to safekeeping

The transaction speed on OpenFund is absolutely phenomenal! 🤗

Everything is pointing to an extreme reduction in rates and a rapid increase of global liquidity, an environment we really haven’t had for risk-on assets since the 2nd half of 2020 so plan accordingly. This is a gift.

PS - just don’t buy SPACs and GME this time.

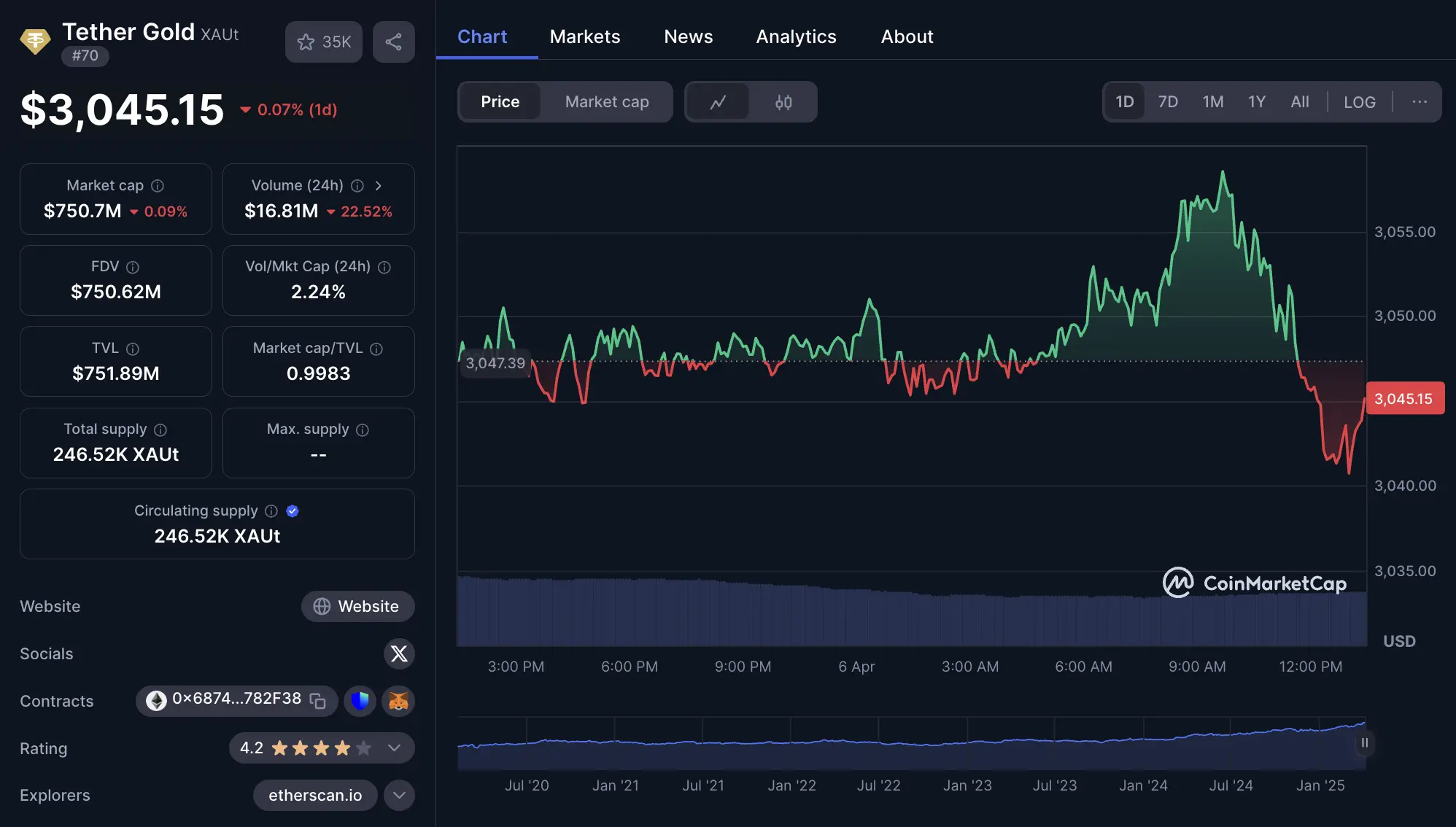

FYI, you can buy Gold via crypto by buying Tether Gold (like USDT but pegged to the price of gold), just don't ask if they actual have a store of gold to back it but it tracks pretty well with the price of Gold. $XAUT