Most of my storis will be of my dog!

Pinned to Storiboard @stori

I've been off of DeSo for a few months.

@Stori brought me right back!

List of side hustles I've had:

👇

Social Media Management

Translating Documents

Garage Sale Flipping

UserTesting

Consulting

Laundry

DJing

They all created about $10k+ in revenue over the course of 5 years.

Some years created more than others.

Some years they fizzled out because I lost interest or time.

But that's money I wouldn't have had otherwise.

That's money I used to take the wife on dates, invest in hobbies, and do fun things without having to dip into the household finances.

Never underestimate a good side hustle!

Posted from @entre

As someone who is long only #crypto and owns more than 50 different #cryptos - I feel the pain too.

Things are worth mentioning:

1) I never planned to be long only(what can you expect from a former hedge fund guy) but haven't spent enough time researching the instruments I want use on the short side( a couple like Zeta Markets look promising). I will use the bear market to do this and will be prepared to hedge once we are nearing ATHs again.

2) I continue to invest incrementally so down markets can be good opportunities to accumulate. That being said only small nibbles until we get signs of recovery before going all in.

On the @CryptoFi Weekly call this past week our technical analysis indicated the downturn was not yet done and suggested we could have a few more weeks/months before we consolidate enough to go higher. I also acknowledged that some #crypto assets are just now at their fair prices/intrinsic value(don't have good calculations for this but used an opportunity cost methodology) even though a few are also quite undervalued. Time to be selective...

Emerging markets and asset classes have always been the toughest to invest in and I have experienced this first hand in the TradFi markets(have some good stories of trying to invest in countries with hyper-inflation and political instability and war).

The only thing I ever really have to say is there is not much general advice that is useful - know your situation and goals and plan for that. Ignore what everyone else is doing.

I signed up for the high risk/high return opportunity of -90% drawdowns and the market delivered!

I'm still here DeSo fam! Been charging ahead in creating my own business so haven't had the time for DeSo interaction. Stil believe in DeSo and can't WAIT for @Stori.

Ever wondered what skills you can take from the film industry and apply to the business world?

Just ask Starla Holder!

The latest episode of Everyday Intrapreneurs featured Starla as a guest.

And

It

Was

Great!

We talk about:

🎥 Her 10 years in the film industry

🎥 What caused the transition into the business world

🎥 How she applied skills she learned in the film world to her everyday work

🎥 How she keeps her job interesting by going out of her way to learn what others do and helping where she can

🎥 If you're the smartest person in the room, it's more boring than 14 hours on a film set!

Check out the episode wherever you listen to podcasts!

Or here's my preferred platform: open.spotify.com/episode/4JjFYVN6tTx2X9c2tLm0OY?si=81851f930bed4ced

Posted from @entre

The best place to learn about crypto! Come join 👍

Crypto Talks tomorrow morning as always(haven't missed a week yet).

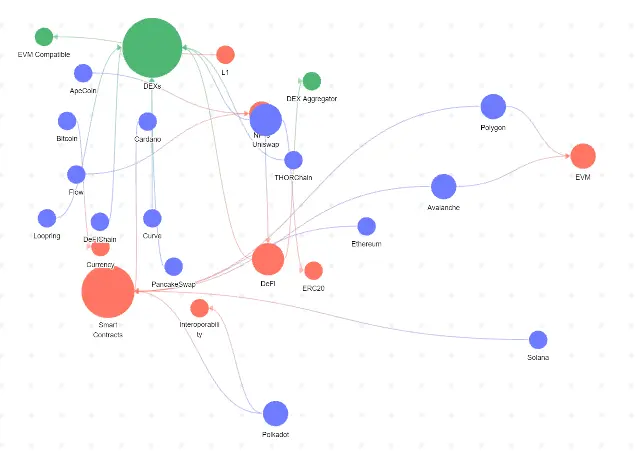

The graph is growing. This week we'll discuss DEXs and add some more details to the graph

We celebrate today and get back to the grind in the morning!

Title: Crypto Talks

Date: May 31, 2022, 10:00 AM - 11:00 AM EST

Details and voting: eventso.xyz/events/629545f34530ce00161c5a83

This week we'll discuss DEXs

Tags: #Crypto # ChimeIn

Users: @CassiusCuvee @Flanagan @SeanSlater @Yazin @Randhir @Brunks

Added by: @darian_parrish

See all @EventSo events on EventSo.xyz

Welp- lost service in the building so that was it for notes from Cryptopia!

Posted via @cloutfeed