AMM Coin Launches for Dummies 🚀

What is an AMM?

An Automated Market Maker (AMM) is a system that sets token prices and fills buy orders automatically. Instead of using traditional buyers and sellers like a stock market, an AMM uses a pricing formula and a pool of available tokens to handle trades.

When a new coin launches on focus, the AMM starts with a set amount of tokens at different price levels. Buyers place bids, and the AMM fills the highest bids first, giving buyers tokens from the cheapest available price levels.

How AMM Pricing Works on FOCUS

When a new coin launches, the AMM is configured with four key settings:

- Start Price: The lowest price at which tokens will be sold. (Example: $0.001)

- Price Increase %: How much the price increases per level. (Example: 10%)

- Final Price: The highest price at which tokens will be sold. (Example: $10.00)

- Total Tokens in AMM: The total supply of tokens available in the AMM. (Example: 97,000 tokens)

Example Scenario

AMM Price Levels Before Any Orders

We're Launching Dummies coin The AMM Settings are as follows:

Start Price: $0.60

Price Increase: 10% (to simplify well say this is just a flat 10c Increase)

Final Price: $1.00

Total Tokens in AMM: 5000

The AMM will create levels from the start price to the end price each one going up by the amount set in price increase. In this example there are 5 levels, so we distribute the total tokens in the AMM evenly between the 5 levels which gives us:

💰 $1.00 → 1,000 tokens

💰 $0.90 → 1,000 tokens

💰 $0.80 → 1,000 tokens

💰 $0.70 → 1,000 tokens

💰 $0.60 → 1,000 tokens

Total: 5,000 tokens in the AMM

How Bids Are Filled

Buyers place bids, and the AMM fills the highest bids first, pulling from the lowest available price upwards.

Let’s look at the order book for 4 buyers placing bids for this new token launch.

| Username | Tokens bid on | price per token |

|---|---|---|

| Bob | 500 | $1.00 |

| Alice | 1200 | $0.90 |

| Charlie | 1500 | $0.85 |

| Susan | 2000 | $0.75 |

Now let's see how the tokens in the AMM are distributed at launch

Bob's Order (500 tokens at $1.00)

✅ Bob places an order for 500 tokens at $1.00.

✅ The AMM fills his order at the cheapest available level ($0.60).

✅ Bob pays $1.00 per token, but the AMM only “sells” the tokens from the $0.60 price level.

📌 Bob pays: $500

📌 The AMM keeps: $200 profit (the use for this is still undecided by Nader)

📌 Remaining at $0.60: 500 tokens left

Alice’s Order (1,200 tokens at $0.90)

✅ Alice places an order for 1,200 tokens at $0.90.

✅ The AMM fills her order starting at $0.60 (500 tokens).

✅ Then, the AMM fills the rest (700 tokens) at $0.70.

📌 Alice pays: $1,080

📌 The AMM keeps: $360 profit

📌 Remaining at $0.70: 300 tokens left

Charlie’s Order (1,500 tokens at $0.85)

✅ Charlie places an order for 1,500 tokens at $0.85.

✅ The AMM fills his order starting at $0.70 (300 tokens).

✅ Then, the AMM fills 1,000 tokens at $0.80.

✅ Charlie still needs 200 more tokens, but there are no tokens left below $0.85.

📌 Charlie’s order is only partially filled with 1,300 tokens.

📌 Remaining at $0.80: 0 tokens left

Susan’s Order (2,000 tokens at $0.75)

❌ Susan places an order for 2,000 tokens at $0.75, but there are NO tokens left at $0.75 or lower.

❌ Her order is completely unfilled.

Key Takeaways

- The Highest Bids are filled from the cheapest price levels first.

- You must bid high enough to guarantee tokens but you’ll still get the lowest possible price.

- The AMM keeps the difference when buyers overpay (e.g., Bob paid $1.00 but got tokens at $0.60).

- If your bid is too low and tokens run out before reaching your price, your order won’t be filled.

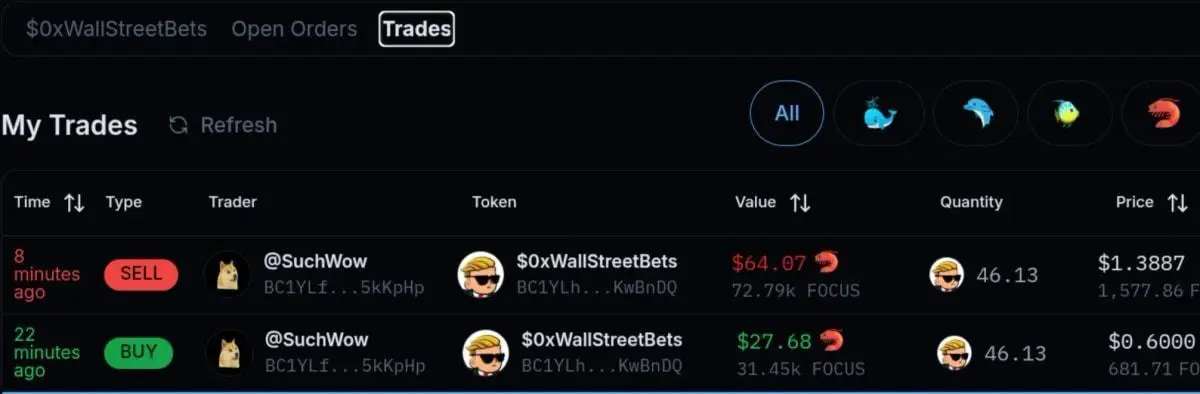

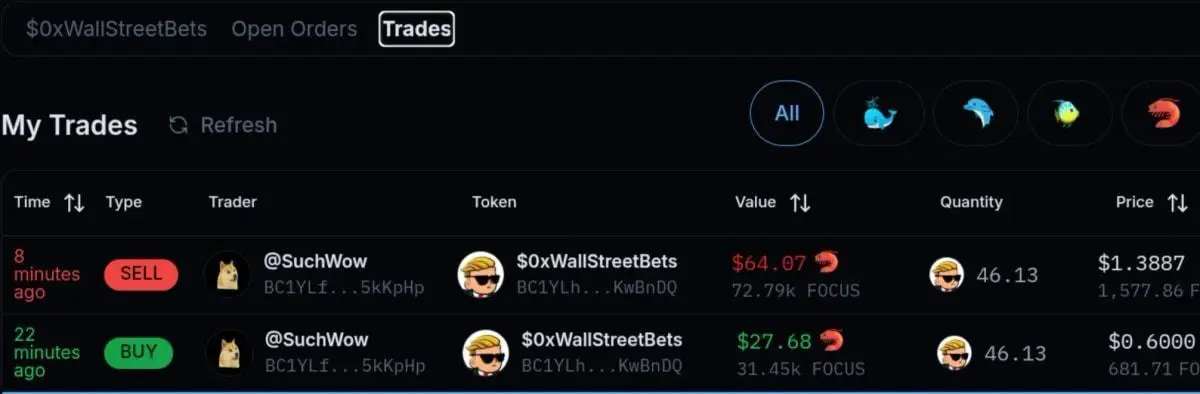

0.36 and then one market order at 0.5 I think.

In and out

0.36 and then one market order at 0.5 I think.

In and out