Done updating, please suggest improvements if you have any.

How to configure your token on Focus? (Free)

A Complete Guide by @TheRenaissanceMan

Most tokens are launching with the default configurations the Focus token launcher provides, which is not a good fit for all tokens. In this article, you will understand how to set all the configurations on the token launcher and launch your token for long-term success.

As this article discuss each configuration options one by one, you can read selectively.

First, Find the Launch token button in the $Trade section and select your category (Meme/Creator/Other).

Once you are in you will see these 3 sections.

We will see each configuration options one by one

Token Properties section

Revenue share - Simply the percentage of your earnings that goes to your token holders. If you earn 100$, with revenue share set to 10%, 10$ goes to your holders instantly which is divided among them proportionally based on their holdings of your coin.

- For meme coins this can be set as high as 100%.

- For creator coins, it's totally up to the creator but anything 1 - 10% is optimal.

Trading Fee - you will get a percentage of every single buy and sell txns on your token. If someone sells 100$ worth of your coins, with 1% trading fee you get 1$.

High trading fee means low volume (People make minimal number of trades to avoid high fees) resulting in low earnings for the creator from trading fees. Very low trading fees allow large volume of trading but minimal earnings from trading fees.

So, the goal here is, to find an optimal point that doesn't discourage traders from making trades but also earn the token owner a fair share.

- For meme coins this should be set to very low (<2.5%).

- For creator coins, it depends on the creator's goal. Anything between 5 - 7.5% is optimal. If the creator encourages long-term holding of their coin and not quick trades, this can be set as high as 30% (while this might affect earnings through trading fees & very low trading volume for the coin).

Ownership This is how much of the total supply you will own.

- For meme coins this should be very low (< 5%).

- For creator coins anything up to 55% is acceptable.

Ownership Lock Up Is how long it takes for the coin you set aside for your-self to become tradable. At least a few months is expected & even longer for creator coins to show their strong belief in their coin's long-term potential.

Yield - Is how much your holders get for locking up your coin. If your coin holders lock their coin for a year, at 10% yield, they will receive their full amount + 10% of your coin after a year. If the creator wants to encourage their holders to hold their coin for the long term, increasing this value may help. But increasing this too much will also increase the supply substantially and inflate the price.

Under danger zone

Lock trading fee - If enabled, you can't change the trading fee you set at launch.

- For meme coins - Recommended

- For creator coins - Not recommended. You may want to increase the fees in the future based on different circumstances (which should be done carefully with announcement).

Permanently lock your revenue share - If enabled, you can't change the revenue share you set at launch.

- Meme coins - Recommended

- For creator coins - Not recommended. You may want to change this in the future to make it higher or lower.

Permanently disable minting coins - If enabled, the supply at launch will be fixed forever.

- Highly recommended. This gives a lot of confidence for buyers/holders and is very unlikely to ever be used.The only case I can see it being used is for **coin splitting - **to mint new coins and distribute it to all holders proportionally to increase the supply and reduce the price/coin. E.g. Your low supply meme coin goes viral, and you don't want it to be 1,000$/coin so you mint and distribute more coins. But it is highly recommended to carefully set your supply at launch and disable this especially for meme coins.

Permanently disable transfer restrictions - If enabled, you can't set restrictions on the flow of your coin.

- For meme coins - Recommended

- For creator coins - Optional

AMM Config Section

Auction Duration The duration before the AMM goes live where buyers can submit bid orders to buy the coin.

- Give a minimum of 24hr to make sure it appears to people in all time zone & make the ending (the last 1hr) land in a suitable time for the time zone/s where most of your buyers reside. Because the real bidding starts at the last minute & If people are not going to be present at the last minute, they usually prefer not to bid at all.

Start price - This is the least price the AMM will start selling from, which will continue to increase (will have increasing price levels starting from this value).

- For meme coins - Meme coins should appear very cheap. A 1000$/coin is not psychologically attractive for a meme coin.

- For creator coins - Higher price gives the creator high perceived values, so can be a higher value.

Order spacing - We said that starting from the "**Start price" **the AMM will continue to increase the price, but it doesn't increase for every coin sold. It increases by phase (Once X amount of coins are sold). Will discuss this later.

The order spacing is the value that determines by how much the AMM price increases every time those X amount of coins are sold out. Taking Start price of 1$ & an order spacing of 10%, the first price level will be 1$, once X amount of coins are sold out, price increases by 10% to 1.1$ & then 1.11$... Each price level becomes Previous level + 10% of the previous level.- The default 10% is optimal for a steady growth unless for a specific reason.

Amount per level - By setting the Order spacing, we have made the price to constantly increase by x% once X amount of coins are all sold out.

Amount per level is that X amount (in dollar) that needs to be sold out to get to the next price level.

Assuming 100$ Amount per level, start price of 1$ and 10% Order spacing,- First price is 1$. Once 100$ worth of the coin are sold at this price (100$/1$= 100coins are sold out), The price is increased by 10% to 1.1$

- Second price is 1.1$. Once 100$ worth of the coin are sold at this price (100$/1.1$ = 91 coins are sold out), Price increases to **1.22$ **and so on.

Let's see the effect of the amount per level in different cases.- If we set very small amount per level, with just a little amount of buying we get to the next price level, so the price will move up quickly & falls too quickly with little sell

- If we set very high amount per level, the price become stagnant, even while there is a lot of buy pressure. Because at each price level, there is a large amount that needs to be sold before going to the next price level.

So, your goal while setting the amount per level is to get an optimal point that brings a steady growth while ensuring price stability. Which means we don't want the price to be stagnant (By making the amount per level too high, where even a million-dollar buying can't take the price anywhere), but we don't also want it to be too sensitive (By making the amount per level too low, where a 100$ buy/sell can bring the price 10x High or low).To identify this optimal amount per level, you need to predict the demand the token might receive. Do you expect millions of dollars to flow? set the amount per level to a higher value, may be a 1000$, so there will be a price increase every 1,000$ is bought insuring steady growth while ensuring price stability.

And this amount per level also relates to order spacing

- if you set very high amount per level and low order spacing, price is almost constant. Because even after a lot of buying, once the large amount at one price level is exhausted, the price is not increased by a lot because the order spacing is small.

- Or if you set too small amount per level and high order spacing, the amount on each price level can be exhausted so easily, and once it's exhausted & price level increases, the increases substantially. (Same for the opposite case, price falls quickly)Amount increase - Previously we saw that we have an amount that need to be sold at each level to go to the next price level. That amount was constant. But we can make it dynamic with this option.

Assuming an amount increases of 10% & 100$ amount per level

it takes 100$ of buying to go to the next price level.

On the next price-level the amount is increased to 110$, So 110$ will need to be bought to go to the next price level and so on.

So, price tend to move more and more slowly as more and more of the coin are bought (100$ buying can get us to next price level but letter we might need 1000$ buying to go to the next price level).

Which means, even with a low amount per level but high amount increase, the price will not move up and down quickly. (It may move up/down quickly initially but as we go up the amount per level is increased so the price is more of stable)\- The default 10% is optimal unless for a specific reason.

Enable Terminal Amount - This is the point where the amount increase will be disabled. It can be done at a specific price/amount. So, once that point is reached, it will disable the amount increase.

- Leave this default unless for a specific reason.

Final Price - Is the price where the AMM stops selling and the only market determines the price. If price falls back below the final price, AMM starts selling otherwise tokens may remain inside of it.

Quote currency - Set it to your buyers preference/Holdings

In this article Meme coins and Creator coins are treated differently due to their fundamental difference in their nature.

Creator coins the creator is the backbone of the token. The existence and growth of the token is associated to the creator's reputation. The creator may also be sharing their earnings through revenue sharing. They are the highest contributor to the token and deservers higher level of rights like owning the majority, higher trading fees and others that are mentioned above. Traders can also feel confident easily as it is unlikely for creators do anything harmful to their token that is directly associated with their own reputation.

Meme coins even though they may be created by a single person, they belong to the community and the creator has no critical role. So, for the community to have confidence in the coin, the creator should not have excessive rights over it.

Tips

- Start by setting your ownership percentage & other token properties.

- Update your configurations and see their effects in the preview tab > Token details & keep iterating until you see what you want.

- If you are not sure of what you are doing, leave permanent configurations.

- For tokens of high-value projects, consult experts as some of the configurations might be permanent.

How pre-sale auction works on Focus? (Free)

A Complete Guide on how to participate in token sale auctions.

By @TheRenaissanceMan

Saw many presale orders bidding way too much than needed, that if they had known how it works can make better trades. So I created this guide on how presale bidding works and how to participate in it.

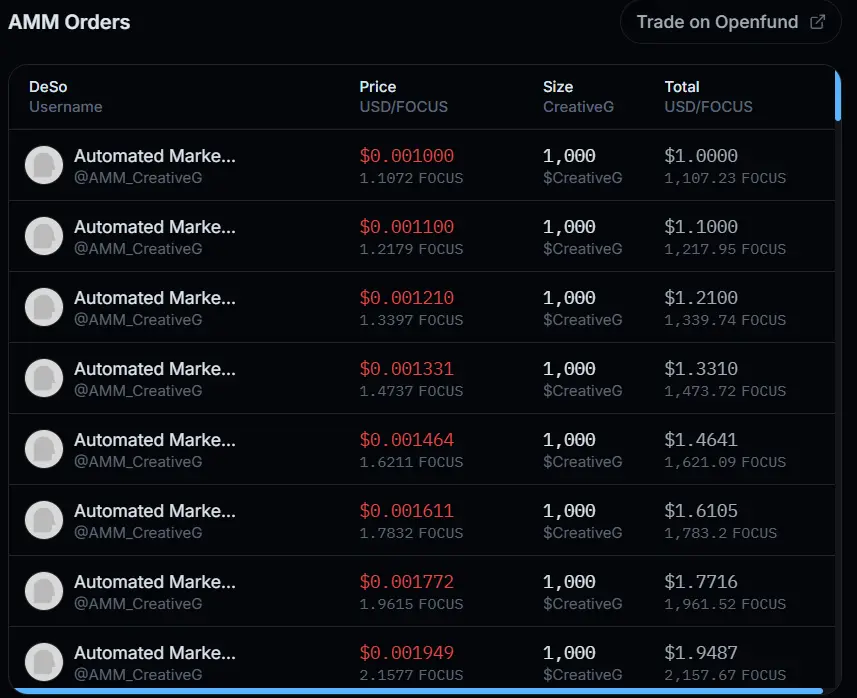

The AMM when first created makes multiple sell orders where the price increase constantly (known as order-spacing) and at each price level there is x amount of coins. See Image below taken from @CreativeG AMM. you can find this at user profile > token tab > AMM tab.

Now based on this AMM let’s see the different Scenarios to understand further.

First Scenario: There are no other bidders than you

If there are no bidders other than you (which is not a good sign but just for example), then you bid at what exactly the AMM is asking for to get the cheapest price.

So you will have an order that looks like this for the example on the Image.

- 0.0010$ for 1000 coins

- 0.0011$ for 1000 coins

- 0.0012$ for **1000 coins **and so on until you reach the amount you want.

Second Scenario: There are other bidders.

In this case you don't buy at the price the AMM is asking for as there are other bidders who are willing to buy at a higher price than the AMM asked. At launch the AMM will start filling the bids from the highest to Bottom. which means, the initial AMM price (The lowest sell price) is matched with the highest bid price.

let’s assume the highest bid is 0.01$ for 2000 coins.

The AMM will match this with the initial AMM sell price (1000 coins for 0.001$, see image above). As 0.01$ (Bid price) > 0.001$ (AMM initial price), the order will be filled. But it is filled with 0.01$ (The bid price), more than what the AMM asked for. (The extra money the AMM earned by selling for higher price that is explained by @nader here).

Now the first 1,000 from the 2000 of the highest bid is filled.

The AMM then goes to second sell price level in the AMM (**0.001098$, **see image above). As 0.01$ (highest bid) is > 0.001 (Second level AMM sell price) the order will be filled again (at 0.01$ price).

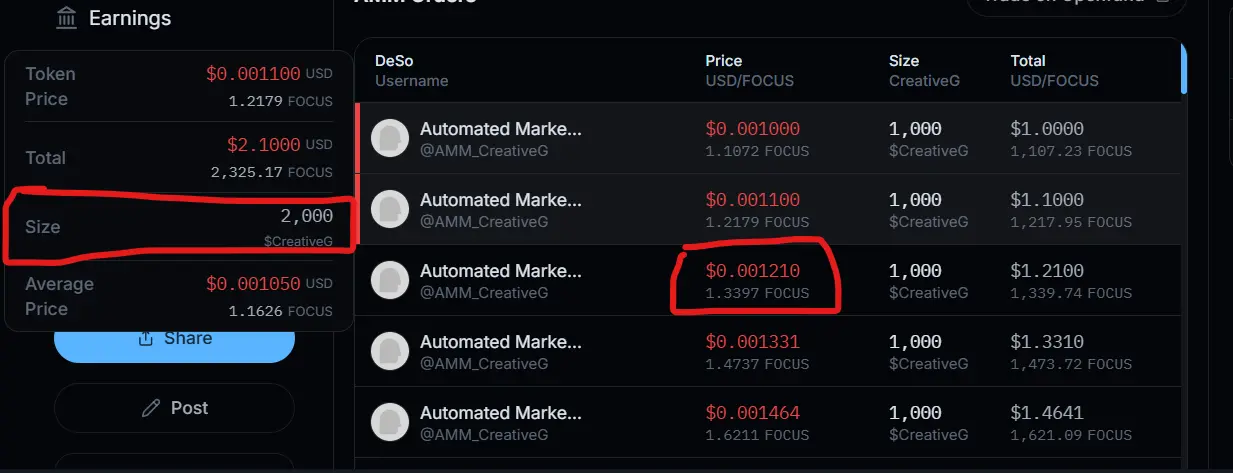

Now the AMM is done with the highest bid. it will move to the second highest bid. By the time it goes to the second highest bid, the lowest two sell orders (By the AMM) are already gone. So, the AMM price when it reaches the second highest order is 0.00121$ (Third level sell price in AMM, see image). If the 2nd bid price is > than the increased AMM sell price, it will be filled. The AMM will continue to fill the prices down to the bottom in this manner.

So, when it is your turn in the bidders list, if your bidding price is < the increased AMM price, your order will not be filled (and so the rest of the orders below you, as they are even lower)

In this scenario you will need to check the highest bid and the AMM price right after the highest bid is filled. And there are two cases.

Case 1 The current Highest bid price is > The AMM price once the highest bid is filled.

Let’s assume 2000 coins for 0.01$ is the highest bid

you first check the price of the AMM after the first 2000 coins are filled (After the highest bid is filled) by hovering over the AMM sell orders starting from top and watching out for the Size you want.

In the above example, the price after the 2000 size is 0.00121. We assumed the highest bid to be 0.01$ for the first 2,000 Coins. But the next AMM prices after the 2000 coins are filled will be 0.00121$ which is much less than the highest bid price. So, you don’t need to fight for the highest bid, you will just bid to buy the next cheapest prices of the AMM.

Assuming you want to buy 2000 coins, You will submit an order

0.001210 $ for 1000 Coins

0.001331 $ for 1000 Coins

but as submitting for each price level might be a tiresome, you can also merge them at little cost.

0.001331 $ for 2000 Coins

Case 2 The AMM sell price once highest bid is filled > The current Highest bid price

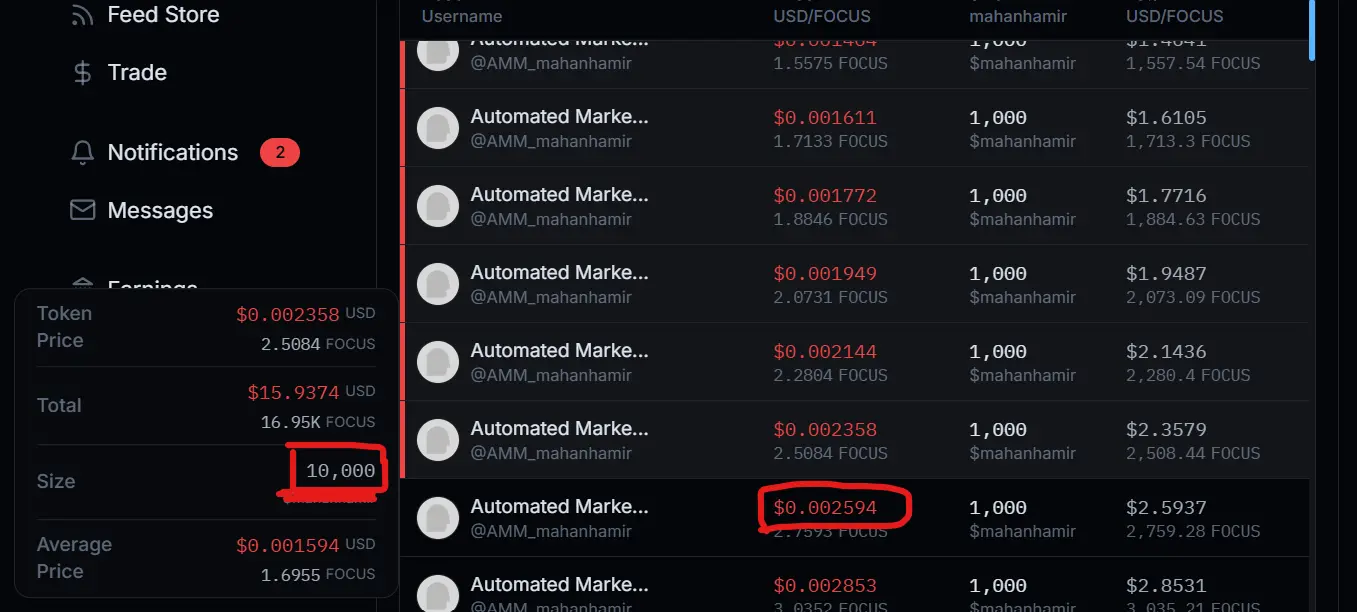

Let’s assume the highest bid is 10,000 coins for 0.001$ each. and the following AMM.

You hover over the AMM list until you see a size of ~10,000 as shown below.

By the time the AMM is done filling the 10,000 coins for the highest bid, the AMM price is going to be 0.00259 Which is greater than the highest bid (0.001$). So you should bid the highest price to get cheapest price.

Tips

- In a real bidding, the bids change a lot at the last second. So be there at the last second to adjust your bidding accordingly and once you identify a good entrance point, you usually need to submit a higher price considering the market changes at last second.

- invest only what you can afford to lose as this is a high-risk market.

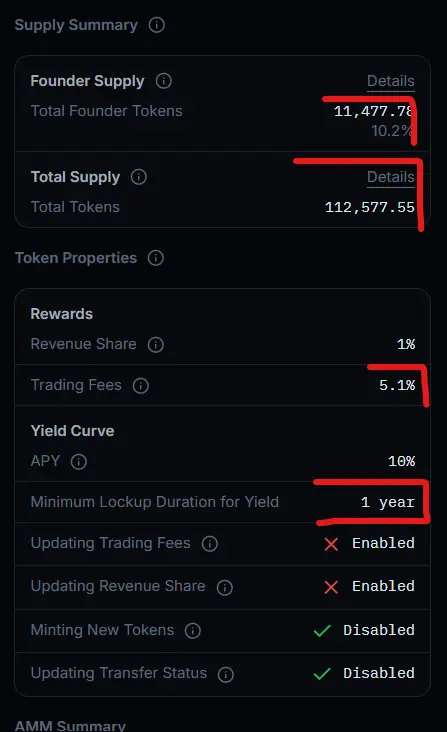

- Always check the all the token properties. Especially Trading fees, Founder supply and Founder lockup and other setting. You can find these at the right or the token graph on open fund (See image below)

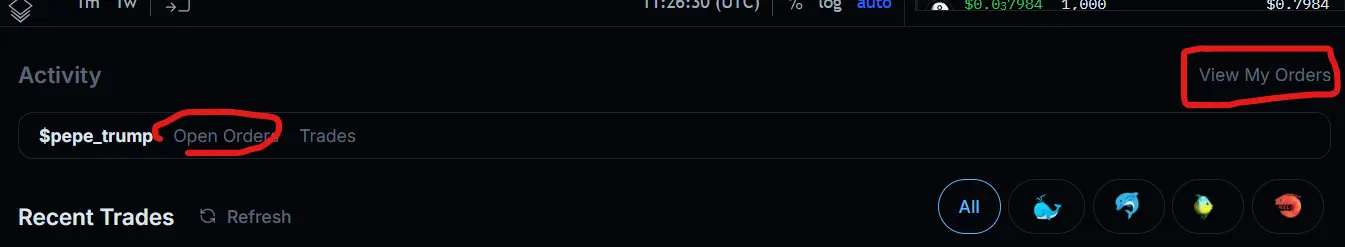

- Always make sure to close your bids once the bidding is over. Every order you make on the bidding is a limit order and it stays open even after the bidding is over. You can find them in the Open orders tab under the graph in Open fund. Or click view orders button at the same place to see open orders on all coins.

- Always be there when the market opens to make sure your bids have passed or otherwise to buy quickly at market price before price soars.

@nader @Mossified @Brootle @mcmarsh please highlight it for improvements and help get this out to new comers.

Forgot to mention @thesarcasm here who made me write this.

Hi, thanks for the detailed explanation. I though I did understand the token sales auction but I miss totally a step. I hope that you can tell me what I do wrong so that I can learn this for the next time

Example:

The amm was

0.001 - 1K

0.0011 - 1K

0.00121 - 1K

0.001331 - 1K

0.001464 - 1k

0.001611 - 1 k

0.001772 - 1k

0.001949 - 1k

0.002144 - 1k

initial bids were

person a , 0.001 for 3K coins

person b, 0.011 for 1K

person c, 0.001256 for 6K

person d, 0.001946 for 3K

According to your description, my thoughts

I will bid with 0.002144 for 8k

There were no other bids so, With my highest bit I can fill every sell from the AMM

But this was not happening

Results:

I got only 2k for a price of 0.002144.

What am I doing wrong because I do not get the picture at all. If you look at the recent sell trades of the AMM for user btcabi, most of them are for the price 0.0022

I do not get it at all

Thank you so much already !!

How often is this scenario likely to occur? (From your text)

"let’s assume the highest bid is 0.01$ for 2000 coins. The AMM will match this with the lowest sell price (0.001$) (See the image above). As 0.01$ > 0.001$, the order will be filled. But it is filled with 0.01$, more than what the AMM asked for. (The extra money that the AMM earned by selling for higher price will be used to buy and burn the token or be rewarded to the creator. But currently, it does nothing). "

As I'm seeing from your example figures

a AMM sale at 0.001$ and 0.009$ goes into some holding wallet? With a filled order at 0.01$

So high % not going to actual token purchase ?

@nader @Mossified @Brootle @mcmarsh please highlight it for improvements and help get this out to new comers.

Forgot to mention @thesarcasm here who made me write this.

Hi, thanks for the detailed explanation. I though I did understand the token sales auction but I miss totally a step. I hope that you can tell me what I do wrong so that I can learn this for the next time

Example:

The amm was

0.001 - 1K

0.0011 - 1K

0.00121 - 1K

0.001331 - 1K

0.001464 - 1k

0.001611 - 1 k

0.001772 - 1k

0.001949 - 1k

0.002144 - 1k

initial bids were

person a , 0.001 for 3K coins

person b, 0.011 for 1K

person c, 0.001256 for 6K

person d, 0.001946 for 3K

According to your description, my thoughts

I will bid with 0.002144 for 8k

There were no other bids so, With my highest bit I can fill every sell from the AMM

But this was not happening

Results:

I got only 2k for a price of 0.002144.

What am I doing wrong because I do not get the picture at all. If you look at the recent sell trades of the AMM for user btcabi, most of them are for the price 0.0022

I do not get it at all

Thank you so much already !!

How often is this scenario likely to occur? (From your text)

"let’s assume the highest bid is 0.01$ for 2000 coins. The AMM will match this with the lowest sell price (0.001$) (See the image above). As 0.01$ > 0.001$, the order will be filled. But it is filled with 0.01$, more than what the AMM asked for. (The extra money that the AMM earned by selling for higher price will be used to buy and burn the token or be rewarded to the creator. But currently, it does nothing). "

As I'm seeing from your example figures

a AMM sale at 0.001$ and 0.009$ goes into some holding wallet? With a filled order at 0.01$

So high % not going to actual token purchase ?