SEC case has entered the chat

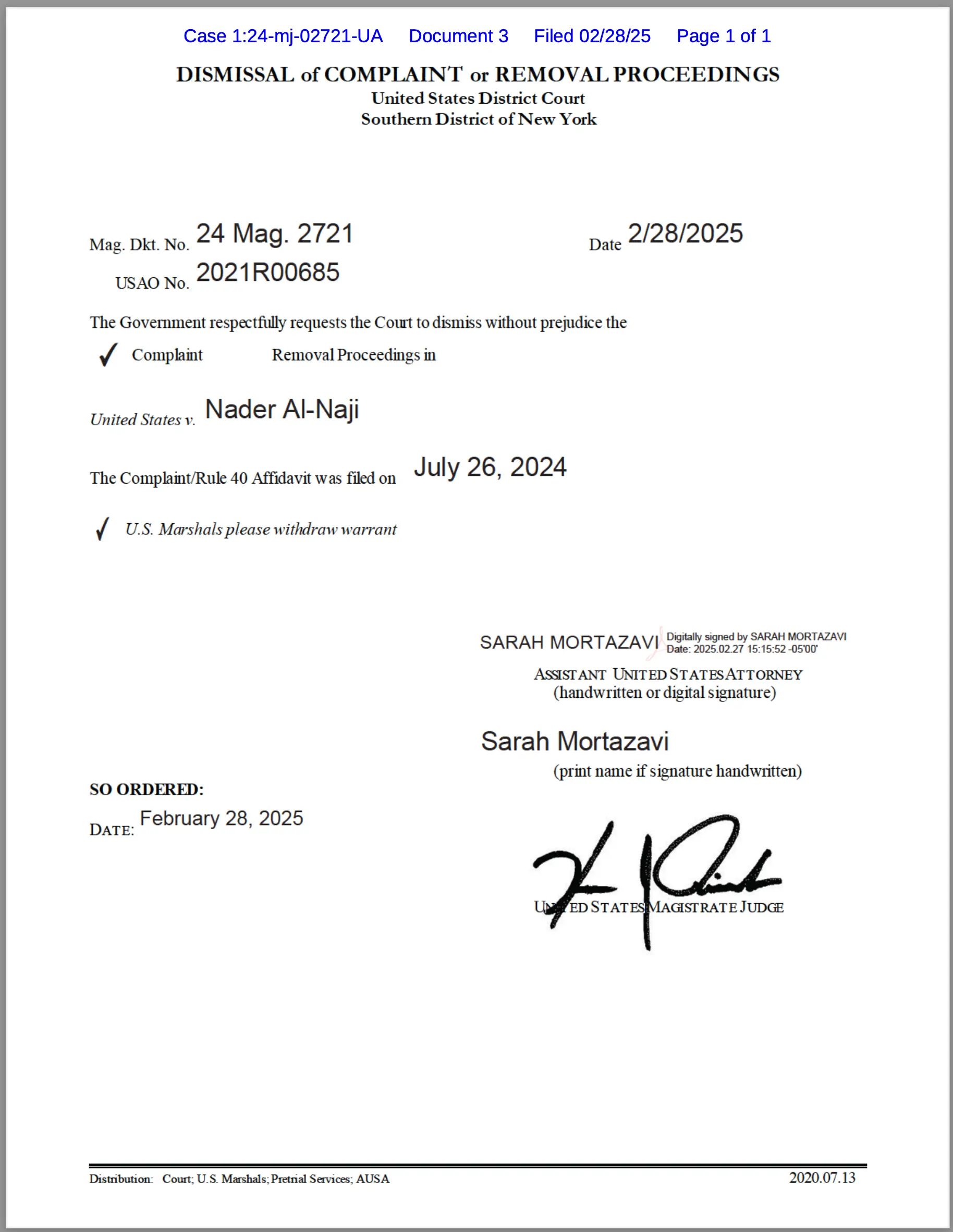

The rumors are true and I can finally talk about it: The DOJ has dismissed its case against me and my name has been cleared.

This is an amazing result for me, for my family, for my team, and for DeSo. There is no limit to what we can achieve from here.

At some point, I'll share my full story. But for now, I just want to clarify a few important points since I can now speak openly.

1. My innocence withstood intense scrutiny. The government meticulously combed through my private texts, my private emails, and even private documents I'd written looking for any shred of wrongdoing. They went to people I'd done business with and essentially pressured them to say bad things about me (which nobody did, not even people I'd let go in the past). The process was extremely adversarial. They weren't looking for a reason to clear me, they were looking for a reason to convict me, and any reason would have worked as long as they thought it would convince a jury.

After months of searching, using every method and tool at their disposal, including applying pressure to those around me, the government decided to dismiss their charges.

It's hard to understate how rare a dismissal like this is. After going through this process myself and seeing what the government is capable of, I believe it's highly unlikely that anyone who has ever done anything wrong, or even anything that "feels" wrong, would ever survive the government's scrutiny without being convicted.

I truly believe it only happened in my case because I've always gone above and beyond to do right by everyone I've ever done business with, and because I truly believe in my heart that what we're doing with DeSo is important for the world (and this came out in all my private communications).

2. There was no victim. In their complaint, the government claimed that a conversation they had with "Investor-1" led them to believe that I had defrauded this investor. Many things were incorrect about this claim after it was scrutinized:

1) I never lied about anything. In fact, I was beyond transparent at all times, and I'm confident that Investor-1 would agree

2) Investor-1 was and still is up on their purchase, even after the government's FUD tanked the price by over 70%

3) I am confident that Investor-1 does not consider themselves to be a victim.

Not only that, but Investor-1 has never been anything less than an amazing partner to me all throughout my career for almost a decade now. When I saw them mentioned in the complaint I immediately suspected that the government had compelled their testimony, and was either misunderstanding or misrepresenting an innocent conversation to reach the conclusion they wanted to reach.

I believe that if you asked Investor-1, the only entity they'd consider themselves a victim of is the US government for wasting so much of their time, and for costing them more in legal fees than the amount allegedly lost to fraud (which to be clear was zero because they are still up on their original purchase of tokens).

In summary: I believe the case that was brought against me consisted of a no-loss non-fraud against an alleged victim who doesn't even consider anything negative to have occurred, other than the actions of the government itself.

3) DeSo is fully-decentralized. Perhaps the allegation that hurt the most was the government's claim that BitClout/DeSo, the blockchain that I've been working on for years now, is not fully-decentralized. They did this by pulling a text message I sent out of context. In the message, I said something like "even something that is fake decentralized would probably still not be a security." Right *after* that message I clarified that BitClout/DeSo is *actually* decentralized, and thus has virtually no securities risk as a result. Unfortunately, the government didn't include that context in their complaint, which in my opinion is an act of bad faith on the government's part.

For the avoidance of doubt, I will say on the record right here and now that BitClout/DeSo has been fully-decentralized from approximately late 2020. To say I thought anything else would not only be wrong, it would contradict actual hard fact.

4) This was some hard stuff. A lot of things about what I went through were hard. One day I will tell the whole story and I think it will be quite interesting for people to hear-- but not today.

I don't want to come off as arrogant or hyperbolic, but I feel I have to give my honest assessment and say that I'm pretty sure something like this would have broken most people. There is something "life or death" about a crisis like this that I feel few working in traditional companies have ever really dealt with, even at the highest levels. At minimum, it would break their team and make it hard to continue to operate normally...

This being said, I'm proud to say that our team remained solidly intact, and we even successfully launched two major products through all the noise: Openfund and Focus (which you should try, by the way), as well as a major network upgrade to Proof of Stake.

I always knew that I hadn't done anything wrong and that it would all get resolved. But everyone around me did as well, including my team. That belief, combined with the absolutely heroic support of my friends and family, made it manageable without too much stress. And of course, it doesn't hurt that I believe DeSo is one of the most important things I can be doing for the world, and worth fighting to the death for.

Lastly, I have to mention that if it weren't for all of the efforts of others in our industry, especially @brian_armstrong and his work with Coinbase, I'm not sure crypto would be where it is today, and I'm not sure we would have gotten such a swift dismissal of my case.

===

In the short-term, I've got big plans for DeSo, Focus, Openfund, and HeroSwap (my team's core products). Every single one is best-in-class at what it does and a potential billion-dollar business on its own. Now that I'm able to operate at full capacity, free from stifling constraints, and with my reputation and network restored, I'm confident we'll realize that potential.

Now, let's get back to work.

Where’s @Krassenstein saying “it’s real” to the dismissals???? 😂😂😂😂😂

Securities and Exchange Commission v. Al-Naji

Based on this document dated March 14 2025 https://www.pacermonitor.com/public/case/54486495/Securities_and_Exchange_Commission_v_AlNaji_et_al

I asked ChatGPT to give some timeline for @nader case... it can go on all the way to 2027 🤣 No FUD, just facts....

1. Early Case Management & Pretrial Phase (March – June 2025)

- March 14, 2025: Court grants an extension for the defendant's response.

- June 6, 2025: Deadline for the defendant to respond to the complaint.

- June 9, 2025: Deadline to submit the joint case management plan.

- June 16, 2025: Pretrial conference (where the judge discusses the case schedule).

2. Discovery Phase (Likely June – December 2025)

- Discovery is the phase where both sides exchange evidence, depose witnesses, and gather facts.

- Can take 6 months to 1 year, depending on how much evidence is involved.

- If expert witnesses are required, it could take even longer.

3. Motions & Pretrial Proceedings (December 2025 – Early 2026)

- Motions to dismiss or summary judgment motions may be filed, potentially resolving the case without trial.

- If the case isn’t dismissed, it moves toward trial.

- Settlement negotiations may intensify at this stage.

4. Trial (Mid-to-Late 2026)

- If the case goes to trial, it could happen anywhere from mid-to-late 2026 or even later.

- Trials can last days or weeks, but scheduling depends on court availability.

5. Appeals (2027 or Later)

- If either party loses and appeals, the case could extend for another 1-2 years in appellate court.

It’s amazing anyone is even able to sell the price should be $1mil/deso

Sell into the right pair, make sure the order is there, sacrifice your first born, stand on one leg, then maybe if open fund is running you get Usdc

@HighKey is it true that The $AB account is now passed over to your control and that you are updating it?

What can the community expect from this coin?

With almost 40% of its value lost and no real input from anyone on its direction or roadmap, what are the next steps?

Tldr.

Looks like AB and Highkey dumped the baby.

$AB posted another pump and dump on his Twitter?? WOW WHO COULDVE GUESS MUCH WOW @HighKey

I love you bro,and I will just remind you .You don't have 220 million in the bank,you didn't build a layer 1.You never got called diamond hands by Gensler You do not run a team of Devs shipping a unique app.You my friend who I do love are along for the ride.Keep salty keep recalcitrant.

I love you bro,and I will just remind you .You don't have 220 million in the bank,you didn't build a layer 1.You never got called diamond hands by Gensler You do not run a team of Devs shipping a unique app.You my friend who I do love are along for the ride.Keep salty keep recalcitrant.

Your guys’ delusion of a celeb coin (that isn’t even ran by the celeb) being the driving force for success really shows me just how retarded even the “smart” people are on here

The real question wtf are you on deso if you are bearish, go home.