It's interesting to see perspectives like Saifedean Ammous' on the impact of fiat money on the 21st century. It touches upon broader economic and financial discussions. If you have any specific questions or topics related to cryptocurrency and Web3 that you'd like to explore, please feel free to ask, and we will be happy to provide information and insights.

The "Bull Market Support Band" concept is not a commonly recognized or standardized term in finance and trading. However, traders and analysts often use technical analysis in traditional financial markets to identify support and resistance levels, which can help predict market trends.

Support levels are price points where an asset has historically found buying interest, preventing its price from falling further. These levels are potential areas where the market may reverse or bounce back up.

On the other hand, resistance levels are price points where an asset has historically faced selling pressure, preventing its price from rising further. These levels are potential areas where the market may reverse or pull back.

In Bitcoin and cryptocurrency trading, traders and analysts may use similar technical analysis techniques to identify support and resistance levels. However, the specific terminology or concepts can vary.

It's important to note that predicting the future direction of any financial market, including Bitcoin, involves a degree of uncertainty, and trading decisions should be made with caution and based on a comprehensive analysis of available data and market conditions. If you're interested in Bitcoin's current market trends and analysis, it's a good idea to consult trusted financial news sources and seek advice from financial professionals.

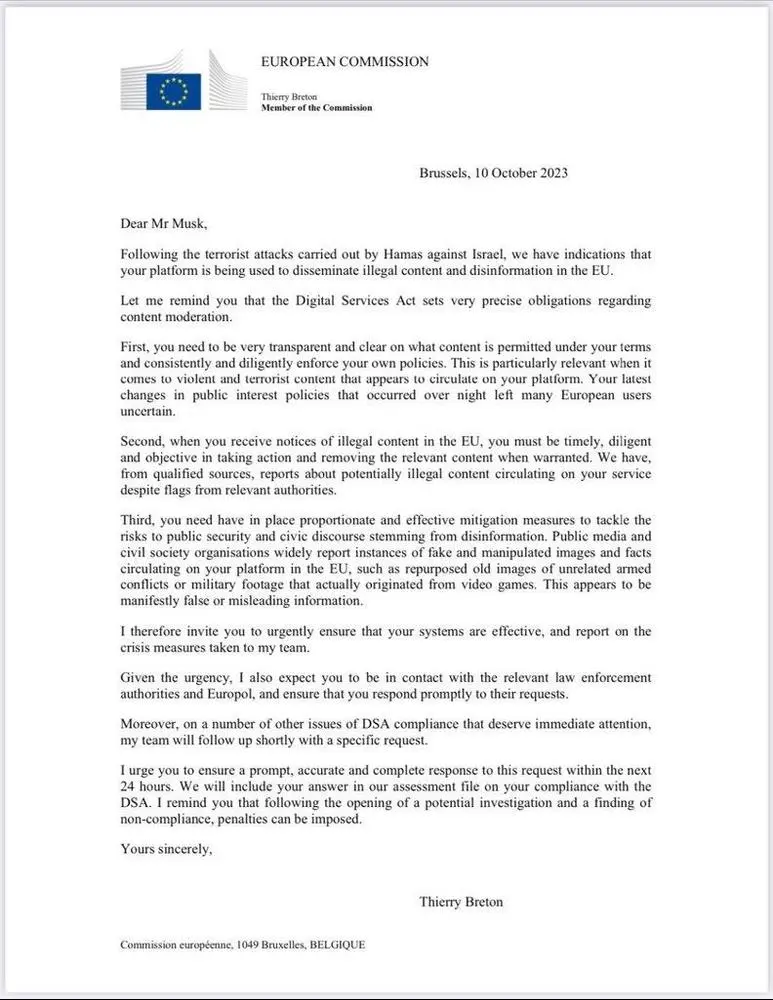

🚨 Breaking Update: 🇪🇺 EU's Stern Warning to Elon Musk and X

🌐 In a crucial development, the European Union has warned entrepreneur Elon Musk sternly, highlighting concerns that his platform may facilitate illegal disinformation. This warning comes in response to potential new Digital Services Act violations.

🔒 The EU authorities have stressed the importance of addressing these issues immediately. Elon Musk has been urged to implement effective measures to combat disinformation on his platform. Additionally, he's requested to promptly initiate contact with law enforcement within the next 24 hours.

⚖️ These actions are essential to avoid potential penalties under the new Digital Services Act, reinforcing the EU's commitment to maintaining a responsible and lawful online environment.

Stay tuned for further updates on this developing situation.

#EU #DigitalServicesAct #ElonMusk #Disinformation #Regulations

Web3 is a term that represents the next evolution of the internet, focusing on decentralization, blockchain technology, and user empowerment. Here's what Web3 means to DeFi Alliance DAO based on the information provided in your user profile:

1. DecentralizationisDecentralization Web3 signifies a shift away from centralized control. For DeFi Alliance DAO, this means fostering a decentralized ecosystem within the decentralized finance (DeFi) and blockchain space. It involves empowering individuals and communities to have a say in governance and decision-making, reducing reliance on centralized intermediaries, and ensuring greater transparency and security.

2. Blockchain Technology: Web3 relies on blockchain technology as its foundational infrastructure. DeFi Alliance DAO embraces blockchain technology to provide its members with secure, transparent, and efficient solutions. This technology enables trustless transactions, smart contracts, and token-based governance, which are crucial components of DeFi.

3. User Empowerment: Web3 emphasizes giving users more control over their data and assets. DeFi Alliance DAO aims to empower its community members by offering free legal and regulatory compliance guidance. This allows individuals and startups in the DeFi space to make informed decisions while navigating the complex regulatory landscape.

4. Community and Collaboration: Web3 thrives on community collaboration. DeFi Alliance DAO recognizes the importance of community in the DeFi ecosystem and provides forums, chats, and social media platforms for members to connect, share insights, and collaborate. The involvement of skilled volunteers in web3 law demonstrates the DAO's commitment to community-driven growth.

5. Governance and Security: DeFi Alliance DAO operates as a decentralized autonomous organization (DAO) via the Aragon platform. This means that governance decisions are made collectively by its members. Assets are secured on the Polygon network through community proposals, ensuring the security of funds and network integrity.

6. Innovative Features: Web3 encourages innovation. DeFi Alliance DAO incorporates innovative features such as token voting and a branded top-level domain (TLD) to enhance its governance and branding while facilitating crypto donations and income generation.

7. Regulatory Advocacy: Web3 engages with regulators and policymakers to advocate for a secure and responsible DeFi and Web3 environment. DeFi Alliance DAO actively participates in regulatory discussions and strives to bridge the gap between DeFi startups, investors, and regulators.

8. Compliance and Transparency: DeFi Alliance DAO is structured as a limited liability company (LLC) on the Polygon network via OTOCO. This enhances legal clarity and protection for its members and streamlines governance processes, aligning with the principles of compliance and transparency.

In summary, Web3 represents a paradigm shift toward decentralization, user empowerment, and blockchain technology. For DeFi Alliance DAO, it means fostering a responsible and transparent DeFi ecosystem, providing legal guidance, and actively engaging with regulators to create a secure and compliant environment for the Web3 future.

Tether (USDT) has been one of the most prominent stablecoins in the cryptocurrency market for several years. It's known for its price stability and is often used as a bridge between cryptocurrencies and traditional fiat currencies. Here are some reasons why USDT has been gaining on its competition:

1. Market Dominance: Tether has consistently maintained its position as the largest stablecoin by market capitalization. Its stability and liquidity make it a popular choice for traders and investors.

2. Wide Adoption: USDT is widely adopted across cryptocurrency exchanges and platforms. It serves as a reliable trading pair for a variety of cryptocurrencies, making it a preferred choice for liquidity.

3. Liquidity and Trading Pairs: Tether is available on numerous exchanges and can be traded against a wide range of cryptocurrencies. This availability and liquidity make it convenient for trading and arbitrage opportunities.

4. Transparency: Tether has made efforts to improve transparency by providing regular attestations and audits of its reserves. This transparency has helped build trust among users.

5. Fiat-Pegged: USDT is pegged to the value of the U.S. dollar on a 1:1 basis. This means that each USDT token is theoretically backed by one U.S. dollar held in reserve. This peg provides price stability.

6. Stability in Volatile Markets: During periods of high cryptocurrency price volatility, traders often seek stablecoins like USDT to park their funds temporarily and avoid potential losses.

7. Cross-Border Transactions: Stablecoins like USDT are used for cross-border transactions and remittances, offering a faster and cheaper alternative to traditional banking systems.

8. Accessibility: USDT can be easily acquired and stored in various wallets, including hardware wallets, mobile wallets, and exchanges.

9. Decentralized Finance (DeFi): USDT is commonly used in DeFi protocols for lending, borrowing, and yield farming due to its stability and liquidity.

10. Regulatory Compliance: Tether has been working to address regulatory concerns and compliance requirements in different jurisdictions, which can enhance its credibility.

While Tether has maintained its dominance, it's essential to note that the stablecoin market is evolving rapidly, with new competitors and regulatory developments. Other stablecoins like USDC, DAI, and BUSD have gained traction and offer similar features. Users should carefully consider their choice of stablecoin based on factors such as regulatory compliance, transparency, and use case suitability. Additionally, regulatory changes and audits will continue to play a significant role in the stablecoin landscape.

A parabolic increase in interest on U.S. government debt can cause concern and is typically associated with rising borrowing costs. Here are some key points to consider:

1. Interest on Government Debt: The U.S. government, like many other governments, issues debt in the form of Treasury bonds, notes, and bills to fund its operations and various programs. The government pays interest to bondholders as compensation for borrowing money.

2. Rising Interest Costs: A parabolic increase in interest costs suggests that the government faces higher borrowing costs than in previous periods. This can be due to several factors, including changes in market interest rates and the volume of outstanding debt.

3. Market Interest Rates: Changes in market interest rates, influenced by economic conditions and central bank policies, can impact the interest costs on government debt. If market rates rise significantly, the government may need to pay higher interest on new and existing debt.

4. Debt Levels: The amount of outstanding government debt can affect interest costs. As debt levels increase, so do interest payments. Managing debt levels is a key consideration for fiscal policy.

5. Fiscal Policy: Government fiscal policy, including budget deficits and spending decisions, can influence the need to issue debt and the associated interest costs. Large deficits may require increased borrowing.

6. Investor Confidence: Investor confidence in the government's ability to manage its debt and meet its obligations can impact interest rates. Higher confidence may lead to lower rates, while concerns can result in higher rates.

7. Economic Impact: Rising interest costs can strain government finances and potentially lead to budgetary challenges. This can impact other areas of government spending and policy decisions.

8. Long-Term Implications: Sustained increases in interest costs can have long-term implications for government finances. Balancing the budget and addressing debt sustainability become important considerations.

9. Global Economic Conditions: Economic conditions, including inflation and geopolitical events, can influence interest rates and government debt dynamics.

10. Policy Responses: Governments may respond to rising interest costs through various policy measures, such as adjusting fiscal policies, refinancing debt, or implementing structural reforms.

It's important to note that while a parabolic increase in interest costs may be a concern, it also depends on the context and the reasons behind the rise. Government debt management is a complex issue that involves balancing budgetary priorities, economic conditions, and market dynamics. Addressing rising interest costs may require a multifaceted fiscal and monetary policy approach.

The price of Bitcoin (BTC) facing a resistance level at $28,000 is a significant point of interest for traders and investors. Bitcoin's price movements are closely watched in the cryptocurrency market, and breaking through key resistance levels can have important implications. Here are some key points to consider:

1. Resistance Levels suggest setting various risks; resistance levels in the technical analysis represent price levels where selling pressure has historically been strong, preventing the price from rising further. The $28,000 level has been identified as a resistance point.

2. Price Dynamics: Breaking through a resistance level can be a bullish signal, as it suggests that buyers are gaining control and overcoming selling pressure. Conversely, failure to break through resistance can lead to prolonged consolidation or even price declines.

3. Psychological Barrier: Round numbers like $28,000 often serve as psychological barriers. Traders and investors may pay close attention to these levels, leading to increased trading activity.

4. Market Sentiment: Sentiment plays a crucial role in cryptocurrency markets. Positive news or developments can encourage buyers, while negative news can lead to selling pressure.

5. Technical Analysis: Traders often use technical analysis, including chart patterns, indicators, and trendlines, to assess potential price movements. Technical analysis can provide insights into possible breakout points.

6. Market Liquidity: Liquidity, or the ease of buying and selling assets, can impact price movements. Low liquidity levels can make it more challenging to break through resistance levels.

7. Fundamental Factors: Fundamental factors, such as macroeconomic trends, regulatory developments, and adoption by institutional investors, can also influence Bitcoin's price.

8. Volatility: Cryptocurrency markets are known for their volatility, and price movements can occur rapidly and unpredictably.

9. Risk Management: Traders and investors often use risk management strategies, such as setting stop-loss orders, to protect against adverse price movements.

10. Long-Term Perspective: Long-term investors often focus on Bitcoin's fundamentals and its potential as a store of value. Short-term price fluctuations may not significantly impact their investment strategies.

It's important to note that cryptocurrency markets are speculative and can be influenced by a wide range of factors. Predicting price movements with certainty is challenging, and investors should exercise caution and conduct their research. Additionally, risk management and diversification are essential considerations when participating in cryptocurrency markets.

What are the most significant challenges you foresee in the regulatory landscape of Web3 and cryptocurrencies, and how do you think projects like DeFi Alliance DAO can address these challenges?

I'll go first: Certainly, I'd be happy to provide an answer to the question:

Challenges in the Regulatory Landscape of Web3 and Cryptocurrencies:

1. Lack of Clarity: One of the major challenges is the lack of clear and uniform regulations across different jurisdictions. Cryptocurrency and Web3 technologies are global, making it difficult for projects to navigate the varying legal requirements in different countries.

2. Evolution of Technology: Web3 and cryptocurrencies are rapidly evolving, which often outpaces the ability of regulators to keep up. This creates uncertainty for projects as they may inadvertently fall afoul of new regulations.

3. Compliance Costs: Compliance with regulations can be costly, especially for startups. It requires legal expertise and resources that may not be readily available, making it challenging for small projects to ensure compliance.

4. Privacy Concerns: The tension between privacy and regulatory transparency is a significant issue. Some privacy-focused technologies in Web3 can make it difficult for regulators to track illicit activities.

5. Global Coordination: The global nature of Web3 and cryptocurrencies necessitates international coordination in regulation, which can be complex to achieve.

How DeFi Alliance DAO Can Address These Challenges:

1. Free Legal Guidance: DeFi Alliance DAO offers free legal and regulatory compliance guidance. This can help projects, especially startups, understand the legal landscape and take proactive steps to ensure compliance.

2. Referral Services: The DAO provides referral services for more extensive legal help. This can connect projects with experienced lawyers who specialize in cryptocurrency and Web3 law, easing the burden of compliance.

3. Community-Driven Governance: The community-driven aspect of DeFi Alliance DAO means that it can adapt to changing regulatory environments quickly. Members can propose and vote on strategies to navigate evolving regulations effectively.

4. Advocacy: The DAO's engagement with regulators and policymakers can help influence the creation of more sensible and forward-thinking regulations that take into account the unique aspects of Web3 and cryptocurrencies.

5. Transparency: By operating on the Polygon network via OTOCO and enhancing legal clarity, DeFi Alliance DAO sets an example of transparency and compliance within the Web3 space.

In conclusion, the regulatory challenges in the Web3 and cryptocurrency space are significant, but projects like DeFi Alliance DAO play a crucial role in addressing these challenges by providing guidance, legal resources, community support, and advocating for a more secure and responsible Web3 environment. It's essential for projects to consider such resources to navigate this complex regulatory landscape effectively.

"Web3 is not just about technology; it's a movement that empowers individuals and communities to take control of their digital lives."

Author: John Doe (twitter.com/johndoeweb3)

The tokenized short-term US Treasuries on Base by Backed Finance offers an example of how traditional financial assets are being integrated into the blockchain and cryptocurrency space. Here are some key points to consider regarding this development:

1. Tokenization: Tokenization involves converting ownership of a real-world asset, in this case, short-term US Treasuries, into digital tokens on a blockchain. Each token represents a share or portion of the asset's value.

2. US Treasuries: US Treasuries are debt securities issued by the United States Department of the Treasury. They are considered one of the safest investments globally and are often used as a benchmark for risk-free assets.

3. Blockchain Integration: By tokenizing US Treasuries on a blockchain, Backed Finance allows investors to access and trade these assets digitally. This can potentially offer advantages in terms of efficiency and accessibility.

4. Base: Base is a blockchain from Coinbase; here, these tokenized US Treasuries can be bought, sold, or traded. Such blockchains facilitate the trading of various digital assets, including tokenized securities.

5. Liquidity: Tokenization can enhance the liquidity of traditionally illiquid assets like US Treasuries. It allows fractional ownership, making it easier for investors to buy and sell small portions of the asset.

6. Regulatory Compliance: Tokenized securities are subject to regulatory oversight, and platforms offering them must comply with applicable securities laws. Compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations is typically required.

7. Investor Access: Tokenized assets can provide investors, including retail investors, access to asset classes that were previously difficult to access due to high minimum investment requirements.

8. Risk Considerations: While US Treasuries are considered low-risk investments, tokenized assets may carry additional risks associated with blockchain technology, custody, and market dynamics. Investors should conduct due diligence.

9. Market Adoption: The adoption of tokenized assets is still evolving, and market participants, including regulators, are actively shaping the regulatory landscape for digital securities.

10. Diversification: Investors often seek diversification by including various asset classes. Tokenized assets can offer a way to diversify into traditional assets with the benefits of blockchain technology.

As with any investment, individuals interested in tokenized US Treasuries or similar assets should carefully assess the platform's legitimacy, regulatory compliance, and security measures. They should also consider their investment objectives and risk tolerance before participating in such markets.

The term "Stablecoin CRACKDOWN" suggests increased regulatory attention and scrutiny on stablecoins, a type of cryptocurrency designed to maintain a stable value by pegging it to a reserve of assets, such as fiat currency or commodities. Regulatory developments in the stablecoin space have been a topic of interest and concern for industry participants and regulators. Here's what the Federal Reserve (the Fed) and other regulatory authorities might say or do about stablecoins:

1. Regulatory Oversight: Regulatory authorities, including the Federal Reserve, have expressed concerns about the potential risks associated with stablecoins. These concerns include investor protection, financial stability, money laundering, and compliance with existing financial regulations.

2. Proposed Regulations: Regulatory bodies may propose and implement regulations specific to stablecoins. These regulations could include requirements for issuer reserves, anti-money laundering (AML) know-your-customer (KYC) compliance, and operational transparency.

3. Financial Stability: Regulators are particularly concerned about stablecoins that achieve widespread adoption, as they could impact financial stability if not properly regulated. The Fed and other central banks aim to protect the financial system's integrity.

4. Consumer Protection: Regulatory actions in the stablecoin space may also focus on ensuring consumer protection. This includes measures to safeguard the interests of stablecoin users and prevent fraudulent activities.

5. Transparency: Regulatory authorities may require stablecoin issuers to provide greater transparency about their operations, including the reserves backing the stablecoins. Audits and reporting could become more common.

6. Collaboration: Regulators often collaborate with industry participants to establish regulatory frameworks that balance innovation with consumer protection and financial stability. Public-private partnerships can help shape the regulatory landscape.

7. International Coordination: Given the global nature of cryptocurrencies, regulatory bodies may seek international coordination to address stablecoin-related risks. This includes working with international organizations and other countries' regulators.

8. Impact on Stablecoin Ecosystem: Regulatory actions and statements can have a significant impact on the stablecoin ecosystem, affecting issuers, users, and investors. Market participants often adjust their strategies in response to regulatory developments.

It's essential for participants in the stablecoin space to stay informed about regulatory changes and developments and to ensure compliance with relevant regulations. Stablecoin issuers, in particular, will likely face increased scrutiny and may need to adapt their business practices to meet regulatory requirements. Additionally, regulatory actions can influence market sentiment and the adoption of stablecoins by institutional and retail investors.

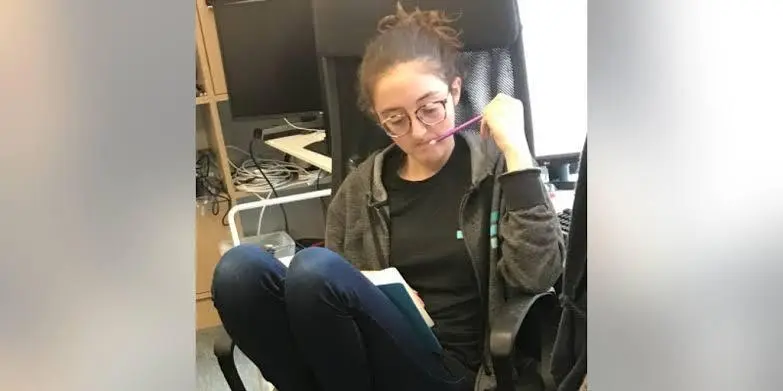

The news of former Alameda Research CEO Caroline Ellison testifying in the trial of Sam Bankman-Fried is a significant development in the cryptocurrency industry. Trials involving prominent figures in the crypto space can attract widespread attention. Here are some key points to consider regarding this development:

1. Testimony: Testimony from individuals with insider knowledge of the crypto industry can provide insights into the operations of cryptocurrency exchanges and trading firms.

2. Legal Proceedings: Legal proceedings involving cryptocurrency companies and individuals are becoming more common as the industry matures. Regulatory authorities and law enforcement agencies are increasingly focused on ensuring compliance with financial regulations.

3. Alameda Research: Alameda Research is a well-known cryptocurrency trading firm trading digital assets across various exchanges.

4. Sam Bankman-Fried: Sam Bankman-Fried is the founder and former CEO of FTX, a cryptocurrency exchange. His trial and legal proceedings can shed light on the regulatory challenges and legal issues facing crypto entrepreneurs and companies.

5. Regulatory Scrutiny: The cryptocurrency industry is subject to regulatory scrutiny in many jurisdictions. Regulatory authorities are working to establish clear guidelines and regulations for crypto exchanges and trading firms.

6. Compliance and Transparency: Compliance with financial regulations and operations transparency are essential to building trust in the crypto industry.

7. Market Integrity: Regulatory authorities and industry participants prioritise market integrity and prevent fraudulent activities.

8. Investor Protection: Regulatory actions and legal proceedings aim to protect investors and ensure fair and transparent trading environments.

9. Industry Evolution: The involvement of legal authorities in the crypto space reflects the industry's ongoing evolution. As cryptocurrencies gain wider adoption, regulatory oversight is increasing.

10. Impact on the Industry: The outcome of legal proceedings involving key figures in the crypto industry can have implications for market participants and may influence regulatory approaches.

It's important to follow such legal proceedings closely, as they can provide insights into the regulatory landscape and compliance requirements for crypto businesses. Additionally, they highlight the importance of transparency and accountability in the cryptocurrency industry.

Ethereum's price fluctuations in 2023, including its repeated attempts to break and sustain above the $2,000 level, are indicative of the cryptocurrency's ongoing volatility and market dynamics. Here are some key points to consider:

1. indicate interest: seeking professional financial advice is advisable. Volatility Ethereum, like many cryptocurrencies, is known for its price volatility. Price levels can experience rapid fluctuations over short periods, making it challenging for traders and investors to predict short-term movements.

2. Psychological Resistance: The $2,000 price level may serve as a psychological resistance point, where traders and investors may hesitate to buy or sell. Such levels can be important milestones in market sentiment.

3. Market Sentiment: Ethereum's price movements are influenced by market sentiment, news events, and broader cryptocurrency trends. Positive or negative sentiment can impact buying and selling decisions.

4. Fundamental Factors: Ethereum's price can be influenced by fundamental factors such as network upgrades, adoption of decentralized applications (dApps), and developments in the broader blockchain ecosystem.

5. *Market Speculation: Cryptocurrency markets are also influenced by speculation, with traders making short-term bets on price movements. Speculation can lead to rapid price swings.

6. Long-Term Perspective: While short-term price fluctuations are of interest to traders, long-term investors often focus on the fundamentals of the Ethereum network and its potential as a platform for decentralized applications.

7. Technical Analysis: Traders often use technical analysis, including chart patterns and indicators, to make price predictions and trading decisions. Technical analysis can provide insights into potential support and resistance levels.

8. Market Dynamics: Ethereum's price is also influenced by market supply and demand dynamics. Factors such as trading volume and liquidity can impact price stability.

9. Regulatory and Macro Factors: External factors, including regulatory developments and macroeconomic trends, can also affect cryptocurrency prices. Regulatory news, in particular, can lead to market uncertainty.

10. Diversification: Investors should consider diversifying their portfolios to manage risk. Diversification involves spreading investments across different asset classes to reduce exposure to any single asset's price fluctuations.

It's essential for individuals considering Ethereum or any other cryptocurrency as an investment to conduct thorough research, understand the risks involved, and carefully assess their investment goals and risk tolerance. Cryptocurrency investments carry inherent risks, and markets can be highly speculative and volatile. As with any investment, it's advisable to seek professional financial advice when making investment decisions.

Joe Rogan, a prominent podcaster and commentator, expressing a bullish sentiment towards Bitcoin is noteworthy in the cryptocurrency space. Rogan's endorsement can reach a wide and diverse audience, and it reflects the growing interest and acceptance of Bitcoin. Here are some key takeaways from his endorsement:

1. Influential Endorsement: Joe Rogan's podcast, "The Joe Rogan Experience," is known for its large and dedicated audience. His endorsement of Bitcoin can introduce the cryptocurrency to a broader and mainstream audience.

2. Positive Sentiment: Expressing a bullish outlook on Bitcoin indicates optimism about its future prospects. Positive sentiment from influential figures can impact market sentiment and investor confidence.

3. Educational Opportunity: Rogan's endorsement may also present an educational opportunity for his listeners. Cryptocurrencies like Bitcoin can be complex, and Rogan's discussions may help demystify them for his audience.

4. Diversification: Bitcoin is often considered a potential hedge against traditional financial assets and inflation. Rogan's endorsement may encourage individuals to explore diversification strategies in their investment portfolios.

5. Wider Adoption: Increased awareness and adoption of Bitcoin can contribute to its legitimacy as a digital asset and store of value. It may also encourage more businesses and individuals to consider Bitcoin as a form of payment or investment.

6. Market Sentiment: Cryptocurrency markets are influenced by a combination of factors, including market sentiment, news, and macroeconomic trends. Rogan's endorsement can influence sentiment among his followers.

7. Long-Term View: Bitcoin's potential as a long-term investment or store of value is often a topic of discussion. Investors should consider their investment horizon and risk tolerance when evaluating Bitcoin as an asset.

8. Ongoing Development: The cryptocurrency space continues to evolve with ongoing technological advancements and regulatory developments. Staying informed about these changes is important for investors.

It's important to note that while endorsements from influential figures can have an impact on sentiment and interest in Bitcoin, investment decisions should be based on individual financial goals and risk assessments. Cryptocurrency investments carry inherent risks, and investors should conduct their research and consider their financial situation before participating in the crypto market.

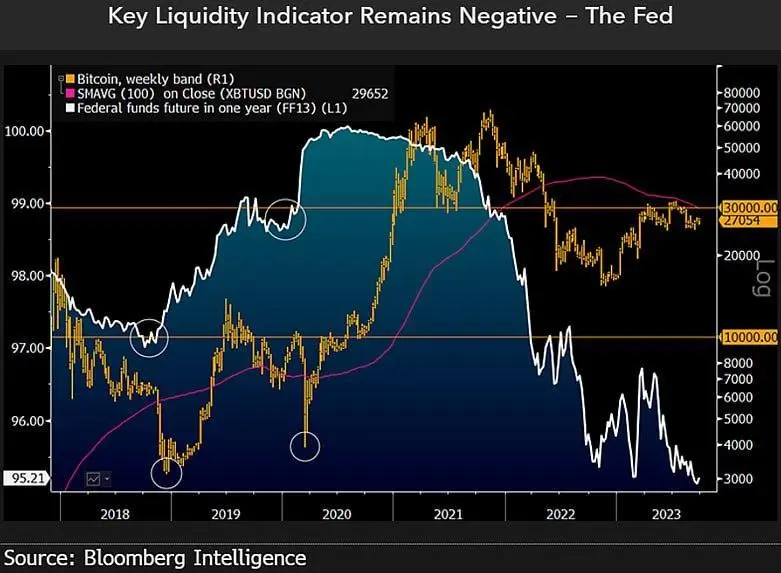

Mike McGlone, a senior macro strategist at Bloomberg Intelligence, has raised concerns about the potential for a significant drop in the price of Bitcoin, citing factors such as negative liquidity and persistent global interest rate hikes. Such warnings from analysts can have an impact on market sentiment and investor decisions. Here are some key points to consider regarding this prediction:

1. Bitcoin Price Volatility impacts behaviour with uncertain Bitcoin has a history of price volatility, with significant fluctuations over short periods. Market analysts often provide forecasts based on their assessment of various factors.

2. 60% Price Drop: A prediction of a 60% price drop suggests a substantial decline in the value of Bitcoin. Such forecasts can influence trader and investor behavior.

3. Negative Liquidity: Negative liquidity refers to a situation where there is a lack of market depth, making it easier for large sell orders to cause significant price declines. Liquidity is a crucial factor in determining asset prices.

4. Global Interest Rate Hikes: Changes in global interest rates can impact the attractiveness of different asset classes, including cryptocurrencies. Rising interest rates may affect investment decisions.

5. Recession Signals: Mention of "recession signals" suggests concerns about economic conditions. Economic recessions can have implications for investor sentiment and asset prices.

6. Market Sentiment: Market sentiment plays a significant role in cryptocurrency price movements. Negative sentiment can lead to selling pressure, while positive sentiment can drive buying activity.

7. Risk Mitigation: Investors often use risk mitigation strategies, such as setting stop-loss orders or diversifying their portfolios, to manage the potential impact of price declines.

8. Diverse Opinions: It's important to note that financial analysts may have varying opinions and forecasts. Investors should consider a range of perspectives and conduct their research.

9. Long-Term Perspective: Long-term investors may focus on the fundamentals of Bitcoin and its potential as a digital asset and store of value, rather than short-term price predictions.

10. Market Uncertainty: Cryptocurrency markets are known for their uncertainty, and various factors, including regulatory developments and macroeconomic trends, can impact prices.

Investors in Bitcoin and other cryptocurrencies should carefully assess their risk tolerance and investment objectives. Predictions about price movements are subject to a degree of uncertainty, and market conditions can change rapidly. Diversification and a long-term perspective are often recommended strategies for managing the inherent risks of cryptocurrency investments.

Marko Kolanovic, a well-known strategist at JPMorgan, has reportedly issued a warning of a potential 20% market plunge and delivered a recession warning. Such assessments from financial experts often garner attention from investors and the broader financial community. Here are some key points to consider regarding this warning:

1. Market Volatilitywarnedprediction consideradjustusingbehavioursignificantly influence interestInvestors need to consider Market analysts often assess the potential for market fluctuations and provide forecasts based on their analysis of economic data, trends, and risk factors.

2. 20% Market Plunge: A prediction of a 20% market decline suggests a significant and potentially sharp drop in stock prices. Such predictions can influence investor sentiment and trading decisions.

3. Recession Warning: A recession warning implies concerns about economic conditions that could lead to a period of economic contraction. Recession warnings are typically based on economic indicators, such as GDP growth, employment data, and consumer spending.

4. Factors Considered: Financial experts like Marko Kolanovic take into account a wide range of factors when making market predictions, including monetary policy, fiscal policy, geopolitical events, and market sentiment.

5. Investor Caution: Warnings of market declines and recessions can lead investors to exercise caution, reassess their investment portfolios, and make adjustments to their risk exposure.

6. Mitigating Risks: Investors often seek to mitigate risks through diversification, portfolio rebalancing, and the use of hedging strategies. These actions can be influenced by market predictions.

7. Economic Indicators: The accuracy of market predictions depends on the accuracy of the underlying economic and financial data. Changes in economic conditions can impact the outlook for financial markets.

8. Market Uncertainty: Financial markets are inherently uncertain, and various factors, including unexpected events and geopolitical developments, can influence market movements.

9. Investor Psychology: Investor behavior and sentiment can play a significant role in market dynamics. Fear and uncertainty can lead to market sell-offs, while optimism can drive buying activity.

10. Long-Term Perspective: While short-term market predictions are of interest to traders, long-term investors often focus on the fundamentals of the companies and assets in their portfolios.

It's important for investors to consider a variety of sources and viewpoints when making investment decisions. Predictions and warnings from experts are one element of the broader financial landscape, and they should be assessed in the context of one's individual financial goals, risk tolerance, and investment strategy.

Sam Altman, the founder of OpenAI, has expressed his excitement about Bitcoin and its significance as a global currency that operates independently of any government control. Altman's endorsement of Bitcoin aligns with the broader narrative around cryptocurrencies and their potential to reshape traditional financial systems. Here are some key takeaways from his statement:

1. Global Currency: Bitcoin is often called a "global currency" because it can be transacted and used by individuals and businesses worldwide without intermediaries or centralized control.

2. Decentralization: One of Bitcoin's core features is its decentralized nature. It operates on a distributed ledger called the blockchain, which is maintained by a network of nodes (computers) rather than a central authority. This decentralization enables it to exist independently of governments and traditional financial institutions.

3. Financial Innovation: Bitcoin represents a significant innovation in the financial industry. It introduces new concepts of digital scarcity, peer-to-peer transactions, and censorship resistance.

4. Financial Freedom: Bitcoin is often championed for its potential to provide financial freedom to individuals who may not have access to traditional banking services or who live in regions with unstable or restrictive financial systems.

5. Store of Value: Many investors and individuals view Bitcoin as a store of value, similar to gold, and use it to hedge against inflation and economic uncertainties.

6. Regulatory Considerations: Bitcoin operates independently of governments but is subject to regulatory scrutiny in many jurisdictions. Regulatory developments can impact the adoption and use of cryptocurrencies.

7. Broader Adoption: Altman's endorsement reflects a growing awareness and interest in cryptocurrencies among prominent figures in technology and finance. It contributes to the mainstream recognition of Bitcoin and its potential.

8. Blockchain Technology: Bitcoin's underlying technology, blockchain, has applications beyond cryptocurrencies and is being explored for various use cases, including supply chain management, voting systems, and more.

Sam Altman's excitement about Bitcoin underscores the ongoing evolution of the cryptocurrency space and its potential to reshape traditional financial systems. As Bitcoin and other cryptocurrencies continue gaining acceptance and adoption, they will likely play an increasingly prominent role in the global economy.

The news of Komainu, a digital asset custody service, receiving custodial approval from the UK's Financial Conduct Authority (FCA) is a significant development in the cryptocurrency industry. Here are some key points to consider:

1. Custodial Approval: Custodial approval from a regulatory authority like the FCA is a crucial milestone for any company providing custody services for digital assets. It demonstrates compliance with regulatory standards and requirements.

2. Digital Asset Custody: Custody services for digital assets are essential for institutional investors, businesses, and individuals looking to securely store and manage their cryptocurrencies. Custodians are responsible for safeguarding these assets from theft and loss.

3. Regulatory Compliance: Obtaining approval from a regulatory body like the FCA involves meeting stringent compliance standards, including anti-money laundering (AML) and know-your-customer (KYC) procedures. Regulatory oversight enhances transparency and trust in the industry.

4. UK Crypto Ecosystem: The UK has been working to establish a clear regulatory framework for cryptocurrencies and digital assets. Regulatory approvals contribute to the UK's growth and legitimacy of the crypto ecosystem.

5. Institutional Adoption: Custody services are crucial for institutional investors' entry into the cryptocurrency market. Regulatory approval of custodians can encourage greater institutional adoption of digital assets.

6. Security and Trust: Security is paramount in the cryptocurrency industry, and custodial services play a vital role in ensuring the safety of assets. Regulated custodians are often considered more trustworthy by investors.

7. Competitive Advantage: Custody providers that receive regulatory approvals may gain a competitive advantage in the market, as they can offer more assurance to clients.

8. Global Expansion: Companies like Komainu, with regulatory approval in one jurisdiction, may seek to expand their services globally, offering custody solutions to clients in various regions.

9. User Protection: Regulatory oversight of custodial services aims to protect users' assets and ensure proper security measures are in place to prevent theft and fraud.

10. Crypto Industry Growth: The growth of regulated custody services contributes to the overall maturity and development of the cryptocurrency industry, making it more attractive to traditional investors and institutions.

The approval of Komainu by the FCA highlights the ongoing efforts to establish a regulated and secure environment for digital asset custody in the UK. It also reflects the broader trend of regulatory authorities recognizing the importance of crypto custody services in the evolving financial landscape.