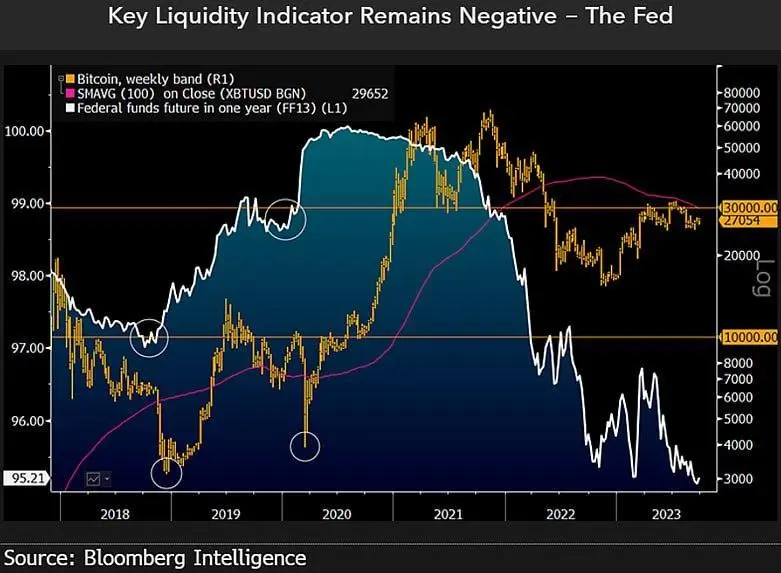

Mike McGlone, a senior macro strategist at Bloomberg Intelligence, has raised concerns about the potential for a significant drop in the price of Bitcoin, citing factors such as negative liquidity and persistent global interest rate hikes. Such warnings from analysts can have an impact on market sentiment and investor decisions. Here are some key points to consider regarding this prediction:

1. Bitcoin Price Volatility impacts behaviour with uncertain Bitcoin has a history of price volatility, with significant fluctuations over short periods. Market analysts often provide forecasts based on their assessment of various factors.

2. 60% Price Drop: A prediction of a 60% price drop suggests a substantial decline in the value of Bitcoin. Such forecasts can influence trader and investor behavior.

3. Negative Liquidity: Negative liquidity refers to a situation where there is a lack of market depth, making it easier for large sell orders to cause significant price declines. Liquidity is a crucial factor in determining asset prices.

4. Global Interest Rate Hikes: Changes in global interest rates can impact the attractiveness of different asset classes, including cryptocurrencies. Rising interest rates may affect investment decisions.

5. Recession Signals: Mention of "recession signals" suggests concerns about economic conditions. Economic recessions can have implications for investor sentiment and asset prices.

6. Market Sentiment: Market sentiment plays a significant role in cryptocurrency price movements. Negative sentiment can lead to selling pressure, while positive sentiment can drive buying activity.

7. Risk Mitigation: Investors often use risk mitigation strategies, such as setting stop-loss orders or diversifying their portfolios, to manage the potential impact of price declines.

8. Diverse Opinions: It's important to note that financial analysts may have varying opinions and forecasts. Investors should consider a range of perspectives and conduct their research.

9. Long-Term Perspective: Long-term investors may focus on the fundamentals of Bitcoin and its potential as a digital asset and store of value, rather than short-term price predictions.

10. Market Uncertainty: Cryptocurrency markets are known for their uncertainty, and various factors, including regulatory developments and macroeconomic trends, can impact prices.

Investors in Bitcoin and other cryptocurrencies should carefully assess their risk tolerance and investment objectives. Predictions about price movements are subject to a degree of uncertainty, and market conditions can change rapidly. Diversification and a long-term perspective are often recommended strategies for managing the inherent risks of cryptocurrency investments.

Haha whoops. My bad.